A summary of our webinar with the Northeast HR Association (NEHRA)

When it comes to health and productivity programs, the past several years have been a time for Benefits and HR professionals to test out a range of initiatives in response to pandemic and post-pandemic challenges, priorities, and employee expectations. Now, however, the market is in a different place and it is time to assess the impact of recent program offerings; does the reward outweigh the risk?

The Big Picture

Today’s economy is creating urgency around making sure benefits programs are properly managed. High inflation rates touch everything; the impact doesn’t stop at the grocery store or the gas pump, it extends to already high healthcare costs. In addition to the economic reality, we have seen an increase in healthcare utilization coming from new treatments and technologies available, further increasing costs. Relatively low unemployment may have shifted attraction and retention goals for some organizations, but a rise in layoffs is having tangible effects on the labor market at large which trickles down to employer strategies. It’s not just employers facing challenges, though, as healthcare services have become unaffordable for many and consumers/employees are also feeling the cost burden.

As a starting point, take a look at your data to answer questions like:

- What does your population look like in terms of demographics and health trends?

- What are your employees selecting for benefits?

- What is driving your costs?

- How might you segment your population?

- Are you accounting for future population shifts and resulting needs (e.g., company growth)?

You should then be able to assess whether or not your benefits align with your population as well as your corporate objectives. When determining true return on investment (ROI), it’s important to consider both human and financial perspectives.

Now that we have established a bird’s eye view of the risk versus reward equation, let’s drill down into key plan components that factor in.

1. Risk Management

There are a range of risks to consider within your benefits strategy. There is the risk of buying insurance, and the allocation of funds. There is the risk to your employees of undertaking a high cost treatment, if necessary, which may not be feasible for lower wage workers.

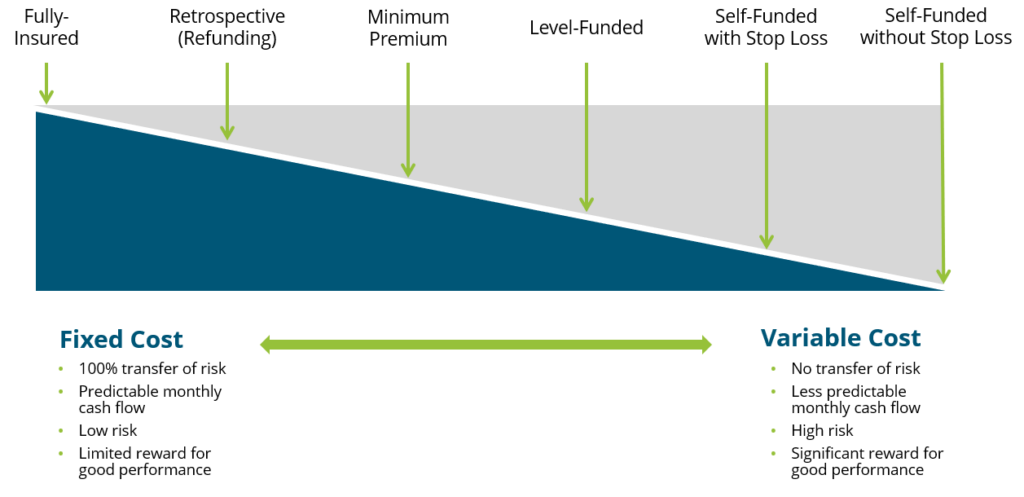

When it comes to benefits funding, the following graphic illustrates the spectrum of options available, where the risk taken by the employer increases as you move toward the right.

While a fully insured plan largely frees the organization of risk, there is typically a lot of overhead and administrative costs involved and less governance when it comes to claims management. Overall, though, we encourage our clients to consider this spectrum and determine where they fit in related to risk appetite, budget and resources, specific health trend, and more.

2. Financial Management

Related but separate from risk management comes the financial management of your benefits program(s). There are three key activities that fall within this bucket:

- Program Strategy

- Account for long-term costs and variability

- Cost Projections and Rate Setting

- Provide budget updates

- Adjust for economic changes

- Includes premium equivalent rate projections and employee contribution rate setting

- Plan Governance

- Establish framework

- Ensure sufficient reporting and monitoring cadence

- Account for actual versus expected, large claims reporting, key cost drivers, retiree medical valuations, etc.

The insights gleaned from the financial management arm should be embedded into your overall benefits and risk management strategy, rather than live in a silo.

3. Pharmacy

Pharmacy has been top of mind for employers, understandably so given the rapid rise in prescription drug costs, which now constitute anywhere from 20-25% of total healthcare spend in the U.S. Specialty medications account for 50% or more of pharmacy spend even though only about 2% of the population is using them. Brand and generic drug costs are also rising at rates we have not seen in the past, perhaps in correlation with inflation. Suffice it to say, employers are struggling to mitigate their own costs as well as the costs for their employees. So, what can be done?

Within the pharmacy benefits landscape, two areas have been getting a lot of attention: weight loss drugs and biosimilars.

Weight Loss Drugs

Chances are you’ve heard about a new wave of “Hollywood diet” drugs. There has been an enormous amount of marketing going on around these new weight loss drugs, especially in the realm of social media and influencers. All of the buzz has also gotten the attention of employers, who are asking us questions surrounding coverage, costs, and pros and cons.

To provide some background, of the four weight loss drugs taking center stage, only two have indications for weight loss, while the other two are being used off-label. Weight loss drugs are not new, but these varieties are showing results we haven’t seen before, and their arrival on the market is timely, as about 42% of the population is either overweight or obese.

From a health and productivity standpoint, we know that obesity increases a person’s risk of developing a chronic condition, which leads to higher healthcare costs. But we also know that there are financial and non-financial reasons to foster a happy and healthy workforce. Can and should weight loss drugs be an answer for employers?

These new drugs are retailing for about $1,300 a month, so we need to consider annual costs and the longevity of how long an employee will need to stay on the medication. For employers considering them to their plan, we recommend it being one piece of a comprehensive strategy that also includes wellness initiatives and/or a commitment from those prescribed the drug. In addition, you must build strong monitoring protocols to judge effectiveness and impact on overall plan costs and utilization.

The inclusion of weight loss drug coverage in a health plan will make sense for some employer groups, and not others. We recently talked with an employer client who saw enough value in even a 10% reduction in body weight to convince them to cover the drug. However, any decisions need to be based, once again, off of population data and corporate objectives. This is a new and evolving sector, so your strategy should remain fluid as we see developments.

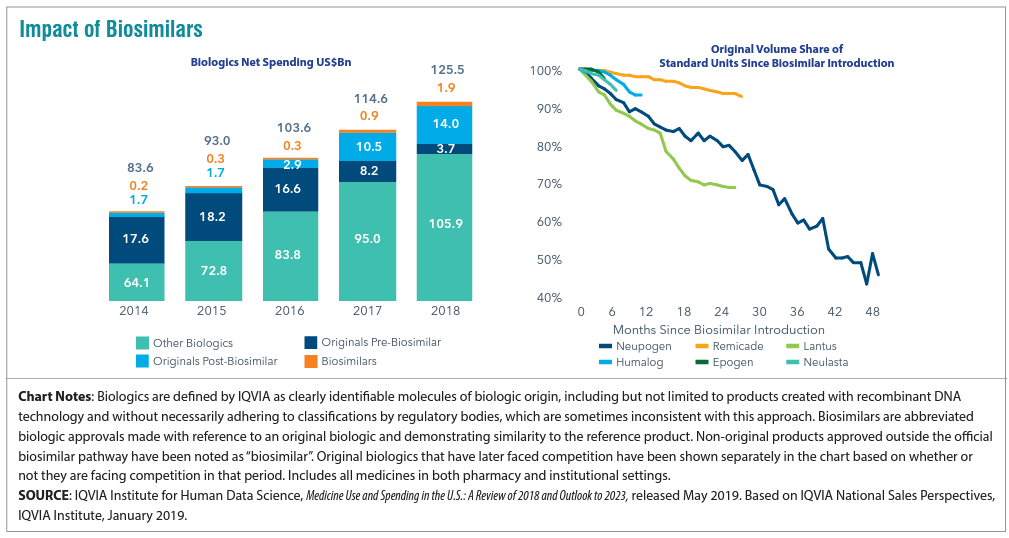

Biosimilars

Biosimilars are non-generic alternatives to those specialized medications that are very targeted in how they work and on what conditions they combat. There has been a lot of anticipation surrounding biosimilars as a solution to the specialty drug cost crisis. At the beginning of the year, a biosimilar of Humira, the number one drug dispensed in the U.S. which is used to treat inflammatory conditions, entered the market as the first biosimilar. While there has been some impact, to date it has not been the silver bullet we were hoping for. We can see below that biosimilar adoption rates are all over the map depending upon the condition for which it’s being utilized.

For employers, what’s important is vigilance in understanding where your Pharmacy Benefit manager (PBM) has positioned biosimilars as far as coverage is concerned. We have found that PBMs are placing biosimilars typically at the same parity with the reference, or brand name product. In this case both Humira and its biosimilar would be considered tier 3 medications, which does not yield the anticipated savings. Why is this? Well, there may be additional rebates available to employers and health plans if they continue to use the reference product.

This is a complicated space that continues to change at a rapid pace. Overall, though, if biosimilars are working the way we want them to, we need to figure out a way for all stakeholders to embrace them as a lower cost alternative instead of being locked into brand name drug prices. In some cases, the drugs are life-changing, so we do want to cover them but in a more sustainable way. We work with clients to ensure they are informed of and ready for these advancements and nuances.

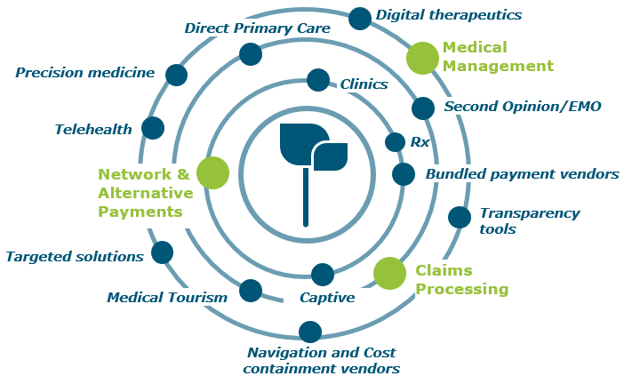

4. Targeted Point Solutions

The term “point solutions” now represents a large umbrella of tools, however it typically references programs that target specific diagnoses such as diabetes, oncology, and hypertension. In recent years there has been significantly more interest in point solutions from our employer clients, and, especially with multiple solutions running at a time, these can be a slow leak on spend. Now is a good time to take a step back to answer that risk versus reward question for point solutions.

The best place to start in assessing point solutions whose reward outweighs the risk is data analytics. Try to use any data you are getting from your health plan, internal teams, or the industry to benchmark your spend. In areas where your spend is high relative to benchmarks, do a deep dive for potential solutions that can help. Some pitfalls in this area include:

- The more point solutions you implement, the harder they become to monitor and manage

- Point solutions embedded in your health plan may seem like a no-brainer, but they usually yield very low take-up rates

- Overlap between different point solutions/benefits programs can cause confusion for all stakeholders

- Focusing purely on dollar ROI may not be the play; listen to your gut about what is right for your workforce and understand the qualitative advantages around camaraderie and culture to be gained

5. Absence Management

Absence management is highly correlated with your health plan performance, since the vast majority of your high cost claims will also include a leave of absence, so there are both plan costs and productivity rates at play here.

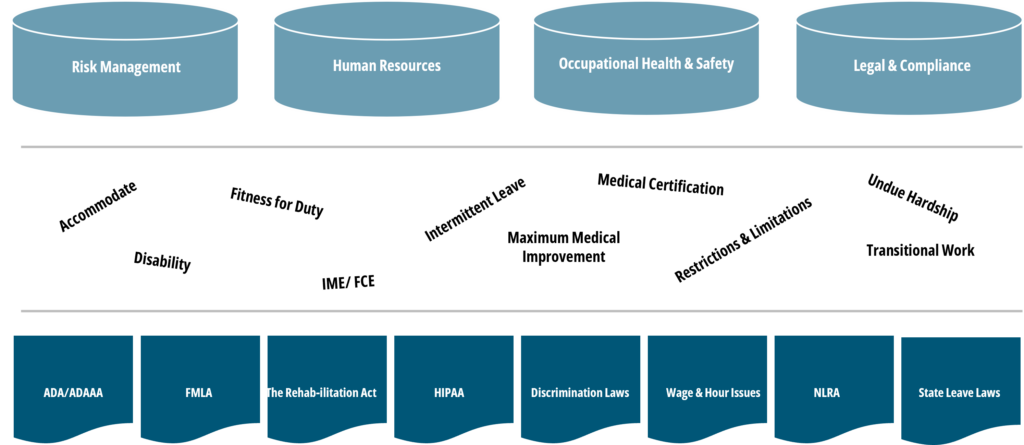

Making absence programs more challenging is the volume of stakeholders involved and laws with which you need to comply (as seen below).

Further, when we talk about absence management, we account for a wide range of benefits including short- and long-term disability, statutory disability, workers’ compensation, FMLA, ADA state paid family and medical leave (PFML), and others.

With absence, different than with medical plans, your company’s managers and supervisors are directly involved when it comes to plan design, governance, staff training, etc., so it is an area where you typically need to look inward to drive change.

When it comes to the risk/reward balance of an absence management program, employers can make sure corporate programs are set up the way they want, for example, promoting the right attraction and retention strategy. Remember that the more generous your programs are, the more they will cost and the higher the risk you take on. If shifting some responsibility to an outsourced partner, be sure you still have monitoring protocols in place.

Closing Thoughts

Across these five areas and more, we encourage you to get familiar with your organization’s plan and demographic data. Depending on your size, the level and depth of data available might be different, but there is always some data available, such as industry standards and benchmarks. Whether you are focused on weight loss drug strategy, funding, or point solutions, you can take those data-driven insights and apply them across these four pillars to determine your best practice.

If you are having trouble getting started, or could use specific guidance surrounding the topics mentioned, please get in touch with our team.