The Problem

In the insurance, healthcare and benefits world, we have been helping clients challenged by things like inflation, hardened insurance markets, rising healthcare and prescription drug costs, remote and hybrid work, and other trends that continue to ebb and flow. On top of these dynamics, many consumers and organizations are beginning to open their eyes to the crisis that is long-term care in the U.S. The issues in this area became alarmingly obvious in the wake of the pandemic, and has continued to remain a top concern over the last several years. State Medicaid programs pick up significant long-term care costs and they are looking for ways to minimize these expenses.

Multiple studies show that 70% of Americans over the age of 65 will need Long-Term Care (LTC) at some point in their life, with the average duration being 3 to 4 years. The cost of an LTC stay is even more unaffordable than other components of healthcare in the U.S., with 2021 national annual averages as follows:

- In-home care: $62K

- Assisted living: $54K

- Private nursing home: $108K

Long-Term Care insurance (LTCi) exists to prepare and provide a cushion for LTC needs. With the LTC costs and expected use of the LTCi policy, individual LTC is expensive. Forbes reported that the average LTCi cost for a male age 60 looking to purchase an LTC pool of $165,000 of coverage costs $1,200 a year. When we weave these factors into the aging population shift we’re experiencing, where the number of Americans aged 65 or older is expected to increase by 47% by 20501, we can see a huge problem on the not-so-distant horizon. Over the last 2 decades, the challenging environment has caused many LTCi carriers to exit the market, making coverage and pricing even more of an uphill battle.

Legislative Developments Driving New Entrants and Programs

Like with Paid Family and Medical Leave (PFML), states are starting to take things into their own hands regarding an LTCi funding solution, recognizing the dire situation for their constituents and the extensive drain LTC puts on publicly-funded programs like Medicare and Medicaid.

The State of Washington was the trendsetter in this area, passing its WA Cares program in 2022, key points of which include:

- A 0.58% payroll tax from employees unless they have private long-term care coverage

- No income cap

- Collection began in July 2023

- A lifetime maximum benefit of $36,500 (adjusted annually for inflation)

- Benefits only eligible for WA residents receiving services in the state

- Recipients must need assistance with three or more activities of daily living (ADLs), such as eating, bathing, dressing, etc.

- Benefits will become available for those eligible in July 2026

- Companies may opt to pay the tax for employees

While Washington may be the first, many other states have LTC legislation on their docket. In 2019, California created a Long Term Care Insurance Task Force to explore the feasibility of developing and implementing a competent statewide insurance program for LTC services and support. To date, the Task Force has made the following recommendations for a more flexible program of that in WA:

- An opt-out provision with a lower tax option if a policy is purchased before the program is enacted

- Reduced contributions if a policy is purchased after program enactment

- Beneficiaries need assistance with at least two ADLs

- Option for employee and employer contributions

- Payroll tax up to 2% with no income cap

The state of the California legislation is still in flux and it is uncertain when it will go into effect. In addition, some sort of LTCi plan is being or has been considered in over 10 other states including Connecticut, Colorado, North Carolina, Georgia, and Oregon. Legislation has been proposed in New York, Massachusetts, Pennsylvania, Minnesota, and Michigan, in addition to the two programs highlighted above.

While the maximum benefit payout (in the case of WA) will not be sufficient for most LTC needs, it is a step in the right direction, necessitating conversation and planning, and reducing some of the state’s burden. We do believe this trend will gain steam and momentum in the coming years. While some may be tempted to “wait and see,” we saw in Washington that many didn’t have time to secure a different option prior to the legal deadline and so were responsible for the tax. For this reason, we strongly advise our clients and their employees to review their LTC options now, while options still exist.

While state LTCi programs such as WA Cares revolve around an employee or employer tax, there is still administrative and compliance burden on employers to withhold, report, and submit those taxes. For these and other reasons, it may behoove employers to explore other options for employees either through a voluntary program or one partially sponsored by the employer.

Solutions in the Market

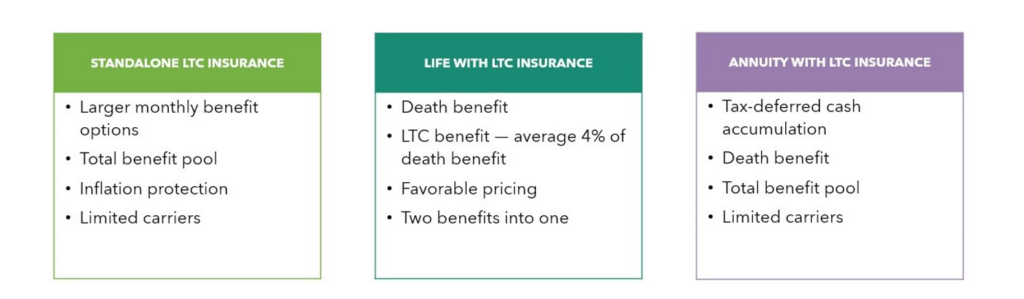

Luckily, long-term care insurance products have evolved from standalone LTC insurance to a hybrid program including life and LTC, or life and chronic illness riders. We also expect to see annuities becoming a bigger option in the future. Traditional medical insurance and long-term disability (LTD) typically will not cover much of anything related to LTC. More prevalent options include the following:

These solutions can be structured for groups (employer-paid or voluntary), executive carve-outs, or for individuals. Underwriting can come in the following formats: guaranteed issue, modified, or full.

Takeaways

For employers, LTC needs and insurance should be one piece of your reward and risk management strategy. We encourage companies to look at the LTCi realm and support employees where they can. A captive insurance model may provide a unique and cost-effective funding strategy. For individuals who already have an LTCi plan, you may want to consider “layering up” to ensure adequate coverage. Take a look at your duration limits, inflation riders, and other components. Regardless of your current position, a statutory LTC program could be coming to your state, and it’s best to be proactive in this area. Your broker/consultant should be equipped to help you navigate this complex landscape and provide solutions that make sense for your organization and its employees.

1 https://www.prb.org/resources/fact-sheet-aging-in-the-united-states/