Unfortunately, news of rising healthcare costs seems less like news and more like the norm. In the last two years, we saw medical cost trend level out a bit, but it’s projected to spike back up. According to a recent survey by PwC’s Health Research Institute, the projected medical trend for 2024 is around 7% year over year, about the same as it was for 2021 and higher than both 2022 and 2023. Other sources predicted an even higher trend, coming in around the 8% – 9% range. Much of the cost burden falls on employees. The Kaiser Family Foundation reports that employees will pay an average of $6,575 for their health plan on a family basis, and around $1,400 for single coverage.

Cost Drivers

What’s behind the increase? There are a range of factors working behind the scenes here, most notably:

- Specialty drug and pharmacy costs. This is perhaps the biggest pain point when we think about overall healthcare costs, with specialty drugs or cell/gene therapy drugs seeing double-digit price increases year over year. The influx of demand for weight loss medications is a significant factor.

- Inflation. While the worst of inflation this go-around might have come and gone, inflationary impacts are typically delayed in the healthcare sector due to the lengths of contracts. This means that provider costs have risen, and that dynamic is playing out in the price of care.

- Healthcare worker shortage. The U.S. Bureau of Labor Statistics projects a need for 1.1 million new registered nurses across the U.S., and an Association of American Medical Colleges report projects a shortage of between 54,100 and 139,000 physicians by 2033.

- The worker shortage is further heightened by the next cost driver: increased utilization. As we finally stave off the extreme effects of COVID-19, healthcare consumers are back in a way they haven’t been since pre-pandemic. According to the International Foundation of Employee Benefit Plans (IFEBP), much of this uptick in utilization is due to chronic conditions.

- Catastrophic claims. IFEBP reports that catastrophic claims are responsible for nearly 20% of cost increases.

It is our job as health and welfare consultants to help employers navigate this landscape and identify solutions that can address the cost curve.

Combative Strategies

In such a difficult environment, it’s important to discern any tactics you can take to establish more control over your plans and create a sustainable program that works better for your organization and your employees. Here are a few of the strategies we typically evaluate on behalf of our clients:

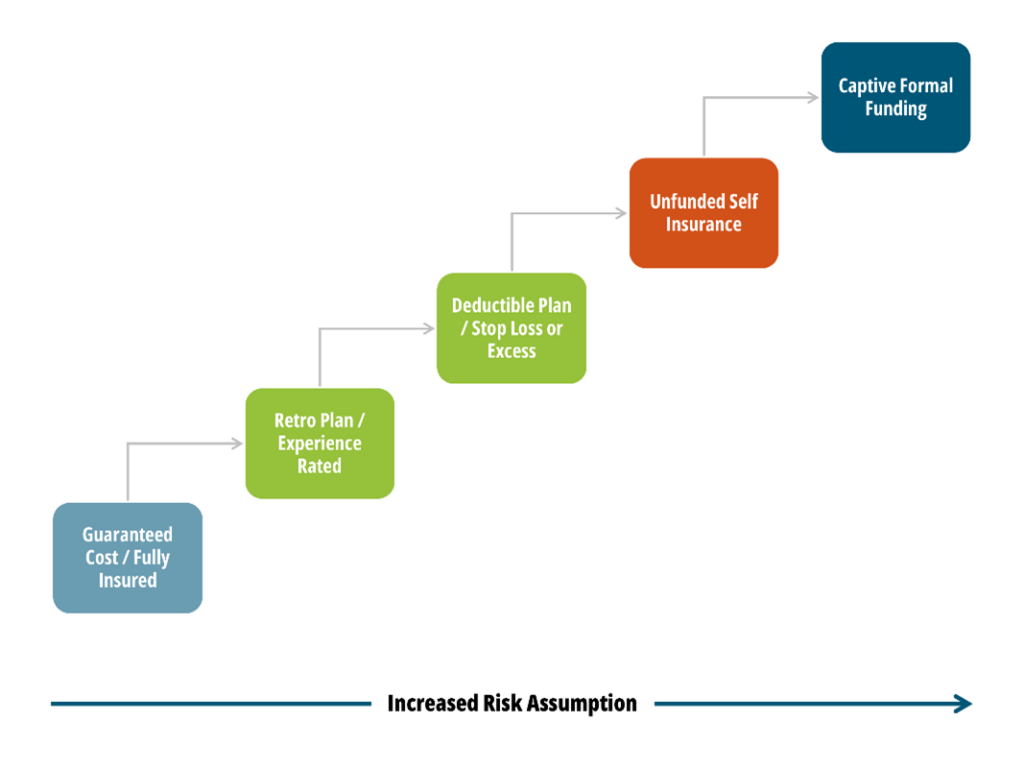

- Alternative funding. By considering an alternative risk financing vehicle like captive insurance, employers can expect to save between 10% and 30% on costs in the long run. However, a range of self-insured models exist for organizations lacking the risk appetite for a single parent captive. This is a trend that has caught on. IFEBP reported that 79% of employers surveyed are self-insured. A captive or similar solution is even more powerful if paired with stop-loss insurance, which can protect against those catastrophic claims we mentioned above.

- Pharmacy benefits strategy evaluation. With the staggering prescription drug prices we are seeing, it is imperative that you ensure your Pharmacy Benefit Manager (PBM) is truly working on your behalf by considering a PBM audit, contract review, or market check. In addition, make sure that you have protocols in place for utilization control, like prior authorization. We also work with clients to improve plan design, utilize clinical programs geared toward population health goals, and dig into data to make informed decisions around possible solutions, whether they be formulary changes, point solutions, or something else.

- Wellbeing. Often overlooked as a buzzword, wellbeing programs can have an impact on your bottom line. To yield results, it’s important to be targeted toward workforce demographics, ensure you can measure success, and that employee engagement is maximized.

- Plan design. It may be time to reevaluate items like cost-sharing (high deductible health plans, copays, etc.), dependent eligibility, the inclusion of telemedicine and mental health, and more.

At Spring, we work across four main pillars: plan design, process, technology, and funding while leveraging benchmarks to look comprehensively across clients’ programs and identify areas for improvement. If you could use objective guidance on how your organization might be able to better manage rising healthcare costs, please get in touch.