There was a flurry of activity at the federal level that involved state and local paid family and medical leave (PFML) programs in the days leading up to President Trump’s inauguration. Both the Department of Labor (DOL) and the Internal Revenue Service (IRS) provided additional guidance and clarification, which is summarized in this Alert.

I. DOL Opinion Letter Clarifies Interaction of FMLA and State of Local PFML Programs

As the paid leave landscape has evolved, employers have struggled with how to reconcile compliance with the Family and Medical Leave Act (FMLA) with that of state or local paid family and medical leave (PFML) programs. While running FMLA, PFML, and other leaves concurrently has been a common and often recommended practice, understanding specific rules that apply in these scenarios has long been a concern for employers. The Department of Labor, in recently issued DOL Opinion Letter FMLA2025-1-A, finally addresses the interplay between the FMLA and state or local PFML programs when an employee’s absence qualifies for both.

The core issue explored in the opinion letter is how the FMLA’s “substitution” rule operates in these concurrent leave scenarios, particularly regarding the use of PFML and whether the same principles as those that apply to disability plans and workers’ compensation benefits apply to PFML. The substitution rule generally allows an employee to elect, or an employer to require that an employee, substitute accrued employer-provided paid leave (including vacation, PTO, or sick leave) while also falling under the protections of unpaid FMLA leave, which means that the employee can elect to have, or an employer can require, that the employer-provided paid leave run concurrently with FMLA leave. Employers have long been uncertain how to apply the rule when state or local PFML benefits are also involved.

The opinion letter clarifies that the FMLA substitution rule does not apply when employees receive benefits under a state or local PFML program, just as it does not when the employee is receiving paid disability or workers’ compensation benefits. This clarification means employees can choose, or be required by their employer, to use their state or local PFML concurrently with FMLA leave. The DOL emphasizes that this coordination is permissible even if the state or local law does not explicitly address the interaction with FMLA and offers employers a clearer framework for managing these often complex leave situations.

Another key takeaway from the opinion letter is that using state PFML concurrently with FMLA leave does not diminish the employee’s protections under FMLA. The FMLA’s 12 weeks of leave remain protected, regardless of whether the employee receives state or local PFML benefits during that time, thereby ensuring that employees receive the full federal protection of the FMLA while also accessing state or local benefits.

Additionally, the DOL’s guidance touches upon the implications of PFML providing partial income replacement. If an employer offers employer-provided accrued paid leave benefits in addition to state or local PFML, the opinion letter suggests that these employer-provided benefits can also be used concurrently with FMLA leave to “top off” the PFML benefit.

This opinion letter is significant because it provides much-needed clarity in an area where confusion often arises. The increasing prevalence of state and local PFML programs necessitates clear guidance on how these laws interact with the FMLA. By addressing the substitution rule in this context, the DOL helps employers navigate the complexities of concurrent leave and ensures employees understand their rights and options.

Ultimately, FMLA2025-1-1 aims to streamline the administration of FMLA leave when state or local PFML is involved, promoting a more consistent and predictable approach for both employers and employees. It reinforces the principle that the FMLA provides a baseline of protection, which can be supplemented by state benefits, without diminishing the federal entitlement.

Next Steps for Employers:

Employers should carefully review DOL Opinion Letter FMLA202-1-A and ensure that their current policies and procedures are consistent with the new guidance.

II. Navigating the Tax Implications of State PFML Programs

The rise of state-level PFML programs has brought a wave of tax-related questions from employers, employees, and other stakeholders. Previously, state guidance on PFML taxation was often vague, leaving many to seek expert advice. However, the IRS issued Revenue Ruling 2025-4, providing much-needed clarity on these complex issues.

Federal Tax Implications:

- Employer Contributions: Generally, employer PFML contributions are excluded from an employee’s gross income and are not subject to FICA, FUTA, or federal income tax withholding.

- Employee Contributions: Employee PFML contributions are typically considered after-tax and are therefore not subject to federal taxation. If an employer funds the employee portion, this payment is considered additional compensation and is subject to FICA, FUTA, and income tax withholding.

- Benefits Paid: The tax treatment of PFML benefits depends on whether the leave is for medical or family reasons, and whether the benefit is attributable to employer or employee contributions. Some states specify contribution allocations (e.g., Delaware, Massachusetts, Minnesota, New Jersey, New York), while others do not, potentially creating ambiguity for employers.

- Medical Leave:

- Employer-Attributable Benefits: Included in federal gross income as wages, subject to sick pay reporting rules, and considered third-party payments of sick pay.

- Employee-Attributable Benefits (or Employer-Funded Employee Portion): Excluded from federal gross income.

- Family Leave:

- Employer-Attributable Benefits: Included in federal gross income (not wages). The state must file with the IRS and issue a Form 1099 to the employee.

- Employee-Attributable Benefits (or Employer-Funded Employee Portion): Included in federal gross income (not wages). The state must file with the IRS and issue a Form 1099 to the employee.

- Medical Leave:

State Tax Implications:

State tax treatment of PFML contributions and benefits varies. Employers must consult the specific laws, rules, regulations, and guidance for each state program to ensure compliance.

PFML Contribution Requirements:

In 2025, state PFML programs have varying requirements for employee and employer contributions when the employer participates in the state plan. Exceptions may apply based on employer size or private plan offerings. Consult the specific state program details for accurate contribution requirements.

Next Steps for Employers:

Employers should carefully review Revenue Ruling 2025-4 and any related state guidance. During the 2025 transition period, adjustments to taxation practices may be necessary. This may include updating employee handbooks, policies, FAQs, payroll systems, and other relevant resources. Proactive compliance is crucial, as employers are generally responsible for the correct administration of these programs.

For further questions or assistance regarding either the DOL Opinion Letter or the IRS Revenue Ruling, please contact Spring.

On September 1, 2024, we celebrated a significant milestone: the 50th anniversary of the Employee Retirement Income Security Act (ERISA). Signed into law by President Gerald Ford on September 2, 1974, ERISA has quietly yet profoundly impacted the lives of countless Americans, ensuring that promises made regarding retirement and health care benefits are promises kept.

ERISA: A Commonly Overlooked Law That Impacts You

While the average American may not recognize the name, ERISA likely plays a crucial role in their lives. This landmark legislation sets minimum standards for most established retirement and health plans in the private sector, providing essential protections for plan participants and beneficiaries in employee benefits plans. From safeguarding retirement savings to ensuring that benefits regulations and requirements are adhered to, ERISA has been a cornerstone in the benefits industry for the past five decades.

A Journey Through ERISA’s History¹

The story of ERISA began with a series of broken pension promises that left thousands of employees without the benefits they were owed. The most notable case was the closure of Studebaker’s South Bend, Indiana plant in 1963, where workers were denied the pensions they were promised. This incident, among others, underscored the urgent need for pension reform and captured the public’s attention.

In response, President John F. Kennedy created the President’s Committee on Corporate Pension Plans in 1961, which issued its report in 1962. Senator Jacob Javits introduced pension reform legislation in 1967, and the momentum continued to build, especially following the release of the 1972 Peabody Award-winning documentary, Pensions: The Broken Promise. Public hearings were held, legislative efforts advanced, and finally, the Employee Retirement Income Security Act was signed into law in September 1974.

Senator Javits, the principal sponsor of ERISA, described it as “the greatest development in the life of the American worker since Social Security.” ERISA has shaped how employers provide retirement and health benefits, working behind the scenes to set standards that protect millions of workers and their families. ERISA was passed by the House in a vote 407 – 2 and unanimously approved in the Senate demonstrating how united the country was behind this important piece of legislation.

The Evolution of Employee Benefits and Captives

ERISA’s influence extends beyond traditional employee benefits. Over the years, there has been notable growth in employee benefits provided through captives—specialized insurance companies owned by the businesses they insure. This trend has enabled companies to have greater control and flexibility over their benefits offerings while managing risks more efficiently. Not all benefits are subject to ERISA, as seen below, but if they are, they need to go through a filing process with the Department of Labor (DOL) to receive a prohibited transaction exemption (PTE). The goal of the PTE process is to ensure that the interests of plan participants in the captive model are still protected, through an additional layer of DOL oversight surrounding fair pricing and compliance.

As captives grow in popularity, they provide new opportunities for employers to offer competitive, tailored benefits while achieving cost control—a trend ERISA has helped enable by providing the regulatory framework necessary for captive expansion and innovation.

Looking to the Future: ERISA’s Continued Relevance

Fifty years on, ERISA remains as relevant as ever. A recent example of ERISA’s modern influence is the tentative approval given by the DOL to leverage a captive to fund pension plan risk for the first time. This development benefits both plan sponsors (employers) grappling with pension plan liability and benefits recipients.

As we navigate new challenges in the benefits landscape—from evolving retirement needs to the complexities of modern healthcare—ERISA provides a foundation that ensures the rights and protections of millions of Americans are upheld.

1 https://www.dol.gov/agencies/ebsa/about-ebsa/about-us/history-of-ebsa-and-erisa

Paid Family and Medical Leave continues to evolve throughout the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in terms of covered workers, benefits paid, leave duration, funding, private plan availability and coordination with other leave programs. Variety across states leads to complexity for employers trying to navigate this landscape. Compliance concerns have also grown as the trend for remote work has continued, and as employers that hire across the nation must comply with laws where employees work.

A summary of changes to benefits and contributions in 2024 is below for each state program. Additional information can be found on Spring Consulting Group’s Paid Family and Medical Leave dashboard.

California

California’s Statutory Disability Insurance (SDI) law went into effect in 1946. In 2004, Paid Family Leave (PFL) requirements were added to the law, making it the first state to create a paid family leave program. In 2024, CA is increasing the contribution rate from 0.9% to 1.1%, which is fully paid by employees. Additionally, the SDI taxable wage maximum is eliminated, meaning all employee wages are subject to the SDI contribution requirement. This change does not apply to voluntary plans. The maximum weekly benefit will remain at $1,620.

Colorado

The Colorado Family and Medical Leave Insurance Program (FAMLI) officially begins paying benefits on January 1, 2024, after 1 year of collecting contributions. The contribution rate will remain at 0.9% of wages, however, Social Security wage limit is increasing to $168,600. Employees are responsible for up to 50% of the total contribution. In 2024, the maximum weekly benefit is $1,100.

Connecticut

The state began collecting contributions on January 1, 2021 and benefits became available one year later in 2022. Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the Social Security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Delaware

The Delaware Paid Family and Medical Leave Insurance program was signed into law on May 11, 2022. The state has been developing rules and regulations prior to contributions beginning on January 1, 2025 and benefits become available on January 1, 2026.

The state was the first to provide an opportunity for employers with comparable leave programs to opt-out of the Delaware Paid Leave and grandfather their employer plan for up to five years. Employers had to submit applications by January 1, 2024. Additionally, employers who are interested in applying for private plans under Delaware PFML will be able to do so beginning in September of 2024.

Hawaii

Hawaii enacted the Temporary Disability Insurance (TDI) law in 1969 and remains the last state (other than Puerto Rico) to not add paid family leave provisions to their statutory disability program.

In 2024, the maximum weekly benefit will increase by $33 to $798. The total contribution rate will vary by employer, however, employers can collect up to 0.5% of the maximum weekly wage base from employees, which equates to $6.87 per week. The maximum weekly wage base in 2024 is $1,374.78.

Maine

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Maryland

Maryland will begin collecting contributions on October 1, 2024, and begin paying benefits on January 1, 2026. The total contribution rate will be 0.90%. Employers can collect up to 0.45% from employees and are responsible for funding at least 0.45%. However, employers with less than 15 employees are not required to contribute the employer portion of the premium. Additionally, employers interested in applying for a private plan will be able to do so this fall.

Massachusetts

Massachusetts Paid Family and Medical Leave (PFML) began paying benefits for medical leave, bonding, and military reasons on January 1, 2021 after collecting contributions for 15 months. Leave to care for a family member began on July 1, 2021. After three years of experience, Massachusetts will be increasing the weekly maximum benefit amount and the contribution rate, effective January 1, 2024.

The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Minnesota

Minnesota is working to develop the rules for PFML. Contributions and benefits are set to begin at the same time on January 1, 2026, which would mean they are one of the only states to not pre-fund a PFML program in recent years. The contribution rate will be 0.7%, with employers funding at least 50%. Beginning in 2024, most employers will be required to submit a report detailing quarterly wages and hours worked for each employee.

New Hampshire

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for six or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers; however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for six weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment processbut may not exceed $5 per week for individuals. No limit applies to employer premiums.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). The maximum weekly benefit is, therefore, $1,945.38 in 2024, an increase from $1,848.46 in 2023.

New Jersey

New Jersey was the third state to create a statutory disability insurance program when the Temporary Disability Benefits (TDB) law went into effect in 1948. In 2008, the state added Family Leave Insurance (FLI).

In 2024, the contribution rate and maximum weekly benefit will increase. The contribution rate will be 0.09%, up from 0.06% in 2023. The taxable wage base for employees will be $161,400. FLI is fully funded by employees. For TDI, employers pay a specific rate between 0.10% and 0.75%, up to the taxable wage base for employers of $42,300. Like in 2023, employees will not contribute towards TDI in 2024.

Earnings requirements have also increased. To qualify for NJ TDB and FLI in 2024, employees must have worked 20 weeks earning at least $283 per week or have earned $14,200 in the base year.

New York

New York Disability Benefits Law (DBL) went into effect in 1949. Paid Family Leave (PFL) was later introduced in 2018. In 2024 the contribution will decrease to 0.373%, from 0.455% in 2023. The rate will apply to wages up to the state average weekly wage of $1,718.15, and is fully funded by employee contributions. The maximum weekly benefit is also increasing to $1,151.16.

Oregon

Oregon benefits began paying on September 3, 2023, after collecting contributions for about 8 months, since the beginning of 2023. Effective January 1, 2024, the contribution rate will increase to 1%, up to the social security taxable wage maximum of $168,600. Employers can collect up to 60% of the total premium from employees. The maximum weekly benefit will remain at $1,523.63 and the minimum weekly benefit will be $63.49.

Puerto Rico

Puerto Rico launched their Non-Occupational Temporary Disability Insurance program, El Seguro por Incapacidad No Ocupacional Temporal (SINOT), in 1968. No paid family leave benefits have been added to date. In 2024, the maximum weekly benefit will remain at $113 ($55 maximum for agricultural workers) and the minimum weekly benefit will remain at $12. No change to the 0.6% contribution rate (up to $9,000 of earnings) has been announced for 2024. Employers may deduct up to 0.3% from employees.

Vermont

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similarly to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Rhode Island

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance1, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased so that employees must have paid at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Washington

Washington began paying on January 1, 2020, after collecting contributions for a year. Effective January 1, 2024, the PFML contribution rate will decrease to 0.74% of an employee’s wage, up to the Social Security taxable wage maximum of $168,600. Employers must fund at least 28.57% and employees will contribute up to 71.43%. The maximum weekly benefit will increase to $1,456 per week.

Washington, D.C.

D.C. Paid Leave benefits began on July 1, 2020, and they had collected contributions since July 1, 2019. Effective October 1, 2023, the District released an updated Notice to Employees, which included an increased maximum weekly benefit, from $1,049 previously, to $1,118. No change has been announced to the 0.26% contribution rate, which is fully employer-funded.

What’s Next?

As the PFML landscape continues to evolve at the local, state, and federal levels, policies need to be monitored on an ongoing basis.

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, Spring’s consultants are happy to help.

All information is subject to change.

1 Dependency allowance provides the greater of $10 or 7% of the benefit rate for up to 5 dependents

As we progress through 2023, maneuvering changing regulations and compliance updates have been challenging for HR professionals across the nation. Many COVID-19 provisions are expiring soon, states are constantly shifting paid leave policies and managing hybrid/remote workforces are just a few hurdles employers are facing when it comes establishing effective and compliant leave programs. Every year the Disability Management Employer Coalition (DMEC) hosts their Compliance Conference, where experts from around the nation discuss current trends in compliance, best practices for employers, and the future of the industry. This year I traveled to the beautiful (and warm) Orlando, Florida, to attend this year’s conference. As per usual, the conference provided a great platform for networking and ensuring attendees are tuned into the most pressing compliance matters.

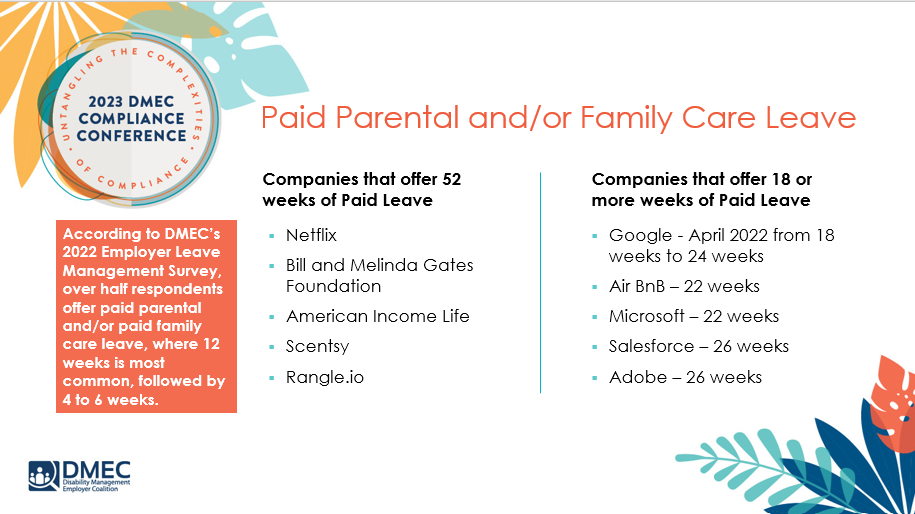

This year, my colleague, Jennifer Campagna and I presented on Navigating Ancillary Paid Leave Options to Support Employee Well-Being, but with a unique twist. We included an interactive game to help attendees understand the benefits of ancillary leave options and how they can intertwine with your current offerings. During the session we handed out “Leave Bingo”, a Bingo-style game where attendees listened for key works and concepts throughout the presentation, to see if they have the words on their Bingo board. Winners received prizes and we all got a little pick-me-up from the chocolate provided. I was impressed with the leave offerings employers across the nation have adopted, some of which we covered in our presentation, like leave related to domestic violence, bereavement, mental health, and more. Although all these ancillary options sound great, they can be costly and difficult to manage from a compliance standpoint.

Aside from the game, we reviewed federal and state laws influencing corporate leave policies and how successful companies are managing their policies. Our presentation included case studies on organizations that implemented alternative leave programs and how it impacted their workforce. Many employers have realized one key to retaining/recruiting talent and combating productivity loss is by revaluating their leave policies and addressing pain points.

Some less traditional types of leave include:

- Religious observance leave

- Wellness days

- Caregiving leave

- Compassionate leave

- Humanitarian leave

- Sabbatical leave

- Time off as a gift or donation

- Time Off in Lieu of Working Overtimes (TOIL)

- Pet bereavement leave

As a board member of DMEC and an advocate for equitable paid leave programs, I am delighted to see where the future of the industry is headed. It is unlikely that we will see a nation-wide Paid Family and Medical Leave (PFML) program introduced in 2023, but we are consistently seeing updates and clarifications to regulations such as the Family and Medical Leave Act (FMLA) and the Americans with Disabilities Act (ADA), in addition to the uptick in state PFML programs and adjustments to existing state plans. Spring and I will continue to keep you up to date with updates in the absence management space and provide our clients with industry-leading programs that best match the needs of their specific workforce.

*Additionally, all Spring/Alera clients receive complimentary access to AleraHR and Alera Dashboard, which provide digital tools that help employers and HR teams manage employee benefits compliance deadlines and updates. It also provides users with a robust compliance library with insightful guides, comprehensive checklists, tools and calculators to create forms, job descriptions, explore salary comparisons.

Background

On election day, Massachusetts voters were asked to approve or reject four ballot questions when casting their votes for Governor and Attorney General. The 2nd ballot question focused on regulating Dental Insurance, which if passed would “require that a dental insurance carrier meet an annual aggregate medical loss ratio for its covered dental benefit plans of 83 percent1” In layman’s terms, this means dental insurers will have to spend at least 83% of premiums on patient care instead of administrative costs, salaries, profits, overhead, etc. The legislation mandates that if an insurance carrier does not meet that 83% minimum requirement, they will have to issue rebates to their customers. It further allows state regulators to veto unprecedented hikes in premiums and requires that carriers are more transparent with their spending allocation.

Prior to election day, Massachusetts did not have a fixed ratio when it came to dental insurance and will soon be the first state in the nation to have a fixed dental insurance ratio. Although MA requires reporting from dental plans, there were no regulations on premiums. The proposed law sets up a protocol similar to what the Affordable Care Act (ACA) requires of health insurers, where in Massachusetts health insurance carriers must spend at least 85%-88% of premiums on care.

Over 70% of voters voted in favor of regulating dental insurance, the most one-sided response of all four ballot questions. Although at face value regulating dental insurance may seem beneficial for patients, the impacts are not cut-and-dry, and the legislation may affect multiple parties, from consumers to carriers and dentists and practice owners.

Leading up to election day, general reactions about the legislation from dental insurance carriers were negative, while it was supported by most dental practitioners. In fact, the ballot initiative was brought to fruition, in large part, due to an Orthodontist in Somerville. As we can see from the polling results, the general population, or consumers/patients, were also in favor of question #2 passing.

Potential Impacts

For patients: On the intangible side for patients/consumers, the law would provide some peace of mind that the money they pay for their dental insurance was going, in large part, to their care. There is also an indirect advantage to increased transparency, mitigating the typical confusion that surrounds insurance plans and payments. More tangibly, the change could mean that insurers are willing to cover more procedures as a means to hit their minimum requirement (good), however that could result in dental practitioners charging more (not so good).

For employers: We anticipate that the new law will give employers who sponsor a dental insurance benefit plan more control over pricing and protection against unreasonable rate increases. Since many businesses do not offer a dental plan, or offer it on a voluntary basis, the effects should be relatively small. On the other hand, if the law were to create a change in the number of carriers in the marketplace, this could have an impact on plan and network options and negotiating power.

For dental practitioners: With the change, one perspective is that dental practitioners will be able to better focus on the best care for each patient. They may also see an increase in business and revenue if insurers are allocating more dollars towards care and procedures.

For dental insurance carriers: Dental insurers largely opposed question #2 for obvious reasons, such as restrictions on how much they can charge and additional requirements they need to adhere to, but also for less obvious reasons. For example, some carriers argue that the law will require them to make up for profit loss by raising premiums, warning that they could increase by as much as 38% in the state2. They have reason to believe this law will lead to less competition in the dental insurer marketplace, which typically does not benefit the consumer.

Conclusion

Having worked with Massachusetts employers of all sizes on their benefits, including but not limited to dental insurance, as well as interfacing with insurance carriers, being the broker representative for a large percentage of dental offices in the state and working with MDS, we are looking at this update from all angles. Our expertise and decades of experience in this industry enables us to make the following conjectures about passing of ballot question #2:

- Dental insurance premiums may rise, but at a minimal rate

- We ultimately believe this is a step in the right direction as an advocate both for our employer clients and their employees, and that transparency is a positive attribute largely missing from the healthcare experience today

- Immediate impacts will also be minimal, but we may see some of the other factors mentioned above play out over the next few years

If you have specific questions about how the new law might impact your dental plan(s) or practices, please get in touch. In the meantime, you might be interested in watching our recent webinar, “Why Long COVID Needs Short-Term Attention” as you develop your 2023 benefits strategies.

1https://www.sec.state.ma.us/ele/ele22/information-for-voters-22/quest_2.htm

2https://www.wbur.org/news/2022/10/18/massachusetts-ballot-question-2-explainer