Unfortunately, news of rising healthcare costs seems less like news and more like the norm. In the last two years, we saw medical cost trend level out a bit, but it’s projected to spike back up. According to a recent survey by PwC’s Health Research Institute, the projected medical trend for 2024 is around 7% year over year, about the same as it was for 2021 and higher than both 2022 and 2023. Other sources predicted an even higher trend, coming in around the 8% – 9% range. Much of the cost burden falls on employees. The Kaiser Family Foundation reports that employees will pay an average of $6,575 for their health plan on a family basis, and around $1,400 for single coverage.

Cost Drivers

What’s behind the increase? There are a range of factors working behind the scenes here, most notably:

- Specialty drug and pharmacy costs. This is perhaps the biggest pain point when we think about overall healthcare costs, with specialty drugs or cell/gene therapy drugs seeing double-digit price increases year over year. The influx of demand for weight loss medications is a significant factor.

- Inflation. While the worst of inflation this go-around might have come and gone, inflationary impacts are typically delayed in the healthcare sector due to the lengths of contracts. This means that provider costs have risen, and that dynamic is playing out in the price of care.

- Healthcare worker shortage. The U.S. Bureau of Labor Statistics projects a need for 1.1 million new registered nurses across the U.S., and an Association of American Medical Colleges report projects a shortage of between 54,100 and 139,000 physicians by 2033.

- The worker shortage is further heightened by the next cost driver: increased utilization. As we finally stave off the extreme effects of COVID-19, healthcare consumers are back in a way they haven’t been since pre-pandemic. According to the International Foundation of Employee Benefit Plans (IFEBP), much of this uptick in utilization is due to chronic conditions.

- Catastrophic claims. IFEBP reports that catastrophic claims are responsible for nearly 20% of cost increases.

It is our job as health and welfare consultants to help employers navigate this landscape and identify solutions that can address the cost curve.

Combative Strategies

In such a difficult environment, it’s important to discern any tactics you can take to establish more control over your plans and create a sustainable program that works better for your organization and your employees. Here are a few of the strategies we typically evaluate on behalf of our clients:

- Alternative funding. By considering an alternative risk financing vehicle like captive insurance, employers can expect to save between 10% and 30% on costs in the long run. However, a range of self-insured models exist for organizations lacking the risk appetite for a single parent captive. This is a trend that has caught on. IFEBP reported that 79% of employers surveyed are self-insured. A captive or similar solution is even more powerful if paired with stop-loss insurance, which can protect against those catastrophic claims we mentioned above.

- Pharmacy benefits strategy evaluation. With the staggering prescription drug prices we are seeing, it is imperative that you ensure your Pharmacy Benefit Manager (PBM) is truly working on your behalf by considering a PBM audit, contract review, or market check. In addition, make sure that you have protocols in place for utilization control, like prior authorization. We also work with clients to improve plan design, utilize clinical programs geared toward population health goals, and dig into data to make informed decisions around possible solutions, whether they be formulary changes, point solutions, or something else.

- Wellbeing. Often overlooked as a buzzword, wellbeing programs can have an impact on your bottom line. To yield results, it’s important to be targeted toward workforce demographics, ensure you can measure success, and that employee engagement is maximized.

- Plan design. It may be time to reevaluate items like cost-sharing (high deductible health plans, copays, etc.), dependent eligibility, the inclusion of telemedicine and mental health, and more.

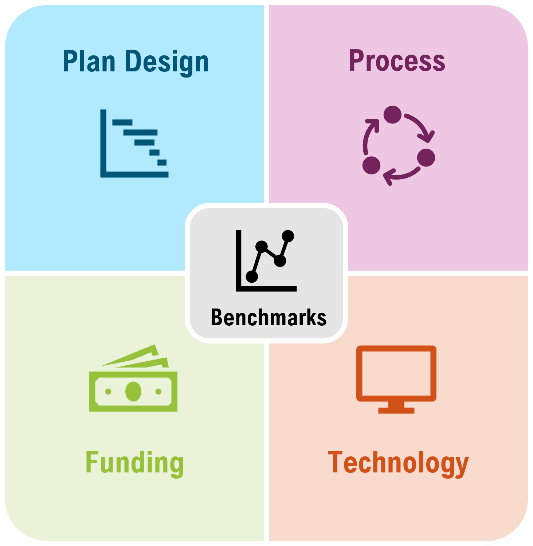

At Spring, we work across four main pillars: plan design, process, technology, and funding while leveraging benchmarks to look comprehensively across clients’ programs and identify areas for improvement. If you could use objective guidance on how your organization might be able to better manage rising healthcare costs, please get in touch.

Current State

Weight loss medications, Glucagon-like peptide-1 receptor agonists (GLP-1RA) s, have risen in popularity beyond anyone’s imagination and there is no sign 2024 will be any different. Endorsements by top Hollywood celebrities, aggressive and compelling consumer marketing, new direct-to-consumer options, and research demonstrating their benefits related to both heart and kidney disease, have left employers wondering if they should rethink their coverage choices.

Many employers have seen the impact on their budgets, adding on average $15,000 annually per patient in pharmacy costs. It is common for employers to focus only on short-term impacts and fail to connect the benefits of weight loss to long-term health care costs and goals. On average, patients who are overweight may incur healthcare costs that are 50% higher than someone of a healthy weight. Is it time we shift our thinking and focus more on the long-term? Is it possible that there is a subset of your population that would benefit from these medications? Would you reconsider your position if the right safeguards were in place?

The Bigger Picture

Did you know?1

- The National Institute of Diabetes and Digestive and Kidney Diseases, reports more than 42% of American adults are obese or severely obese, a rate that has almost doubled since 1980.

- Obesity is second only to smoking as a preventative cause of death in the United States.

- Every 5-point increase in BMI results in a 32% increase in risk of developing heart failure.

The American Medical Association (AMA), the World Health Organization (WHO) and other medical boards have recognized obesity as a chronic disease by for well over a decade. It is a complex metabolic condition that is impacted by genetics, behavior, and environment. Obese individuals have too much fatty tissue stored as energy within their bodies and their ability to change the body’s response to excess fatty tissue is often unsuccessful despite great efforts. 1 2 3

Obesity’s role in the development and/or progression of many chronic diseases, such as type 2 diabetes, hypertension, cardiovascular disease, kidney disease, stroke, sleep apnea, osteoarthritis, and certain types of cancer, is well documented. A person with obesity has an 80-85% risk of developing type 2 diabetes, and cancers associated with excess weight contribute to 40% of all cancers. It is easy to overlook that obesity not only impacts the physical body but also a person’s mental health.

The CDC reports that more than 50% of adults diagnosed with moderate to severe depression who were also taking an antidepressant were obese. Overall, 43% of adults with depression were obese compared with 33% of adults without depression, and women with depression were more likely than men to be obese. This was true across all age groups among women and was also seen in men aged 60 and older. 3 4

To Include or Exclude

As we enter 2024, the demand for weight loss medications continues and is anticipated to increase since much of 2023 was plagued with drug shortages. Despite these shortages, the average employer saw double digit increases in the GLP-1RA category which includes drugs for both diabetes and weight loss. Many employers continue to struggle, unable to justify unrestricted access and coverage for their members while striving to offer benefits that provide value and fair access.

As employers look for innovative ways to combat soaring healthcare costs, re-evaluating coverage of weight loss medications to a subset of members could be a critical piece of the puzzle. The International Foundation of Employee Benefit Plans (IFEBP) reports that 22% of employers in the U.S. currently cover prescription drugs for weight loss, and 32% offer weight management programs. Another survey showed up to 42% of employers were revisiting coverage for 2024 and beyond. 5 6 3

This year started off with somewhat of a curveball in this area, with Eli Lilly announcing LillyDirect, a direct-to-patient portal, allowing some patients to obtain its newly released drug, Zepbound (tirzepatide) for as little as $25 a month. LillyDirect uses the telehealth platform, FORM, where patients reach independent telehealth providers who can complement a patient’s current doctor or serve as an alternative care option. This news has been received with mixed emotions. Many obesity experts feel this is a long overdue service that improves access and addresses affordability concerns. Others feel this is another move by manufacturers to circumvent health plan sponsors and improve their market share. Many are calling for transparency between telehealth providers and the pharmaceutical company to rule out any conflicts of interest. 7

If you are exploring adding weight-loss drug coverage to your plan, a critical first step is to ensure members are educated about these drugs, essentially demystifying the media hype. The truth is these drugs are expensive, have side effects, and cannot do the job alone. Inadequate education regarding the side effects and how to manage them has caused many people to stop therapy, resulting in wasted healthcare dollars. The medications must be part of a comprehensive program that highlights the importance of healthy food and physical exercise. Members need to understand their responsibilities and how they will be held accountable for demonstrating their continued commitment to the plan. It has been demonstrated that those who stop the drugs regain, minimally, 75% of the weight because long-term behavioral changes and/or healthy eating habits did not form. 8 2 9 10 3

Employers also need to find ways to monitor their financial interests, such as:

- They must be active participants in designing coverage criteria and ongoing monitoring parameters.

- They must ensure they create a comprehensive approach, complete with a robust clinical review and ongoing monitoring at frequent intervals to evaluate a member’s response to therapy. As part of that, employers need to recognize the importance and impact that social determinants of health and health equity have when discussing weight.

- Determine ways to implement opportunities for members to access healthy food choices and physical activity and add additional wellness incentives to your benefit offerings.

- Be sensitive to the views/ or needs of your employees; do not make the out-of-pocket expenses so significant that they essentially restrict access.

- Finally, monitor your financials closely, request frequent in-depth reporting, and hold your PBM accountable for ensuring appropriate coverage/monitoring, access to competitive pricing, rebate incentives and formulary placement.

Conclusion

Ultimately the choice to cover these medications is an organizational decision, but it’s critical to have all the information necessary to make this decision, starting with a robust view of your population demographics. With high rates of obesity for most health plan sponsors, a prudent and thoughtful approach to expanding weight-loss coverage will be required. Attempts like this to tackle the obesity epidemic could produce long-term savings with lower overall healthcare costs, prevention of progression of existing diseases, and, most importantly, a better quality of life and employee experience. It has also been demonstrated that many people would remain at a job solely to retain coverage if offered and approximately 44% of people surveyed reported that coverage of these medications could be an important decision point in whether to accept a new position. 11 4 12 13 14 6 8

No matter your decision on offerings, the more you can offer through communications and education will help your plan participants make informed decisions and understand their role in achieving and keeping weight off. To realize tangible results, all parties must be committed. If you could use guidance around weight loss drug strategy or would like a clinical pharmacist to assess your population and needs, please get in touch with the Spring Team team.

1 https://www.cdc.gov/obesity/data/adult.html

2 Obesity Statistics. The European Association for the Study of Obesity.

3 Public Health Considerations Regarding Obesity. StatPearls

4 https://www.hsph.harvard.edu/obesity-prevention-source/obesity-consequences/health-effects/

5 https://ir.accolade.com/news-releases/news-release-details/glp-1-coverage-employer-plans-could-nearly-double-2024

6 https://www.cdc.gov/nchs/products/databriefs/db167.htm

7 https://investor.lilly.com/news-releases/news-release-details/lilly-launches-end-end-digital-healthcare-experience-through

8 https://icer.org/news-insights/press-releases/icer-publishes-evidence-report-on-treatments-for-obesity-management/

9 https://www.webmd.com/diet/obesity/obesity-health-risks

10 https://www.npr.org/sections/health-shots/2023/01/30/1152039799/ozempic-wegovy-weight-loss-drugs

11 https://jamanetwork.com/journals/jama/fullarticle/2812936

12 https://www.ama-assn.org/press-center/press-releases/ama-urges-insurance-coverage-parity-emerging-obesity-treatment-options

13 https://www.milliman.com/en/insight/payer-strategies-glp-1-medications-weight-loss

14 https://www.niddk.nih.gov/

Spring has been recognized as one of the Top Employee Benefits Consulting firms in Massachusetts by Mployer Advisors, who focus on connecting employers with top-rated insurance advisors. We’d also like to congratulate our colleagues at Boston Benefit Partners, An Alera Group Company, for making the list as well! You can find the full update here.

Demand for new weight loss medications continues to rise and employers remain concerned about budget impacts if they decide to offer these costly medications as part of their benefit package. These medications, known as GLP-1 agonists have skyrocketed in popularity and are thought to be “miracle drugs” by many. The reality is that weight loss requires a multi-modal approach and not all people who use them will achieve significant weight loss. Studies have shown that once discontinued, patients gain an average two-thirds of the weight back1. The reality is there is no miracle cure, but these medications have helped to destigmatize obesity and make clear the benefits of taking a multi-faceted approach to sustain weight loss.

Employer Case Study

As is the case with many organizations, weight loss drug strategy was recently of particular interest to one of our clients, edHEALTH. The client was interested in the positive impacts yielded but was daunted by the complex dynamic of long-term cost versus benefit.

Spring assisted edHEALTH in assessing a best practice avenue for weight loss drugs, keeping in mind that spending on obesity-related conditions result in approximately a 12% increase in total healthcare costs2. Wegovy (semaglutide) has an average price of approximately $1,349 a month, or more than $15,000 annually. That is more than double what the Institute for Clinical and Economic Review (ICER)3, a private entity that provides an independent source of evidence review and creates cost-analysis reports, recommends, instead stating that Wegovy should be priced somewhere around $7,500–$9,800 per year to fall into the cost-effective threshold.

We worked with edHEALTH and its PBM partners to fully understand their weight loss medication utilization management and monitoring parameters. As a member consortium, edHEALTH is committed to providing their member institutions with the information needed to assist them in determining the best cost-management strategies. Therefore, a key part of our evaluation was to prioritize the education of staff and faculty on the protocols and side effects of these medications to potentially narrow the interest to those highly motivated groups. There is no one size fits all solution, but there are specific points of consideration and educational resources that can help organizations of any kind address this topic with stakeholders.

Additional recommendations included:

- Ensuring plan participants understand that treatment should extend beyond the medication

- A comprehensive approach is critical and ideally includes behavior-management coaching, nutrition support, an exercise plan, and accountability check-ins.

- Non-medication initiatives might include fitness reimbursements, nutrition programs like WW (formerly Weight Watchers), and/or employee walking challenges. Incentives should be woven into these programs.

- Reauthorization requirements with the PBM should be in place (approximately every 6 months) to confirm patients are receiving the expected positive response to therapy related to goals.

For example, edHEALTH hosts an annual walking challenge between member schools, with prizes and check-ins along the way. The healthy competition creates a simple yet effective way to get employees moving more than they might otherwise, and a tactic like this pairs nicely with an overarching weight loss strategy.

Considerations for Employers

Ultimately the choice to cover these medications is an organizational decision, but it’s critical to have all the information necessary to make this decision, starting with a robust view of your population demographics. With high rates of obesity for most health plan sponsors, a prudent and thoughtful approach to expanding weight-loss coverage will be required. Attempts like this to tackle the obesity epidemic could produce long-term savings with lower overall healthcare costs, prevention of progression of existing diseases, and most importantly a better quality of life and employee experience.

No matter your decision on offerings, the more you can offer through communications and education will help your plan participants make informed decisions and understand their role in achieving and keeping weight off. To realize tangible results, all parties must be committed.

Our clinical pharmacist and benefits consulting team is here to help you assess weight loss as a component of your benefits strategy, including not only weight loss drugs but also wellbeing initiatives and data analytics for monitoring success. Get in touch for assistance in navigating this nuanced and rapidly evolving area.

1 https://www.nbcnews.com/health/health-news/happens-stop-taking-wegovy-ozempic-many-people-regain-weight-rcna66282

2 https://www.hsph.harvard.edu/obesity-prevention-source/obesity-consequences/economic/

3 https://icer.org/news-insights/press-releases/icer-publishes-evidence-report-on-treatments-for-obesity-management/

As pharmacy and prescription drugs continue to drive healthcare costs for employers. Many are reevaluating their Pharmacy Benefit Manager (PBM) arrangement to ensure transparency, strategic alignment, and fair pricing. Click here to access our Q&A and generate your PBM Report Card.

A summary of our webinar with the Northeast HR Association (NEHRA)

When it comes to health and productivity programs, the past several years have been a time for Benefits and HR professionals to test out a range of initiatives in response to pandemic and post-pandemic challenges, priorities, and employee expectations. Now, however, the market is in a different place and it is time to assess the impact of recent program offerings; does the reward outweigh the risk?

The Big Picture

Today’s economy is creating urgency around making sure benefits programs are properly managed. High inflation rates touch everything; the impact doesn’t stop at the grocery store or the gas pump, it extends to already high healthcare costs. In addition to the economic reality, we have seen an increase in healthcare utilization coming from new treatments and technologies available, further increasing costs. Relatively low unemployment may have shifted attraction and retention goals for some organizations, but a rise in layoffs is having tangible effects on the labor market at large which trickles down to employer strategies. It’s not just employers facing challenges, though, as healthcare services have become unaffordable for many and consumers/employees are also feeling the cost burden.

As a starting point, take a look at your data to answer questions like:

- What does your population look like in terms of demographics and health trends?

- What are your employees selecting for benefits?

- What is driving your costs?

- How might you segment your population?

- Are you accounting for future population shifts and resulting needs (e.g., company growth)?

You should then be able to assess whether or not your benefits align with your population as well as your corporate objectives. When determining true return on investment (ROI), it’s important to consider both human and financial perspectives.

Now that we have established a bird’s eye view of the risk versus reward equation, let’s drill down into key plan components that factor in.

1. Risk Management

There are a range of risks to consider within your benefits strategy. There is the risk of buying insurance, and the allocation of funds. There is the risk to your employees of undertaking a high cost treatment, if necessary, which may not be feasible for lower wage workers.

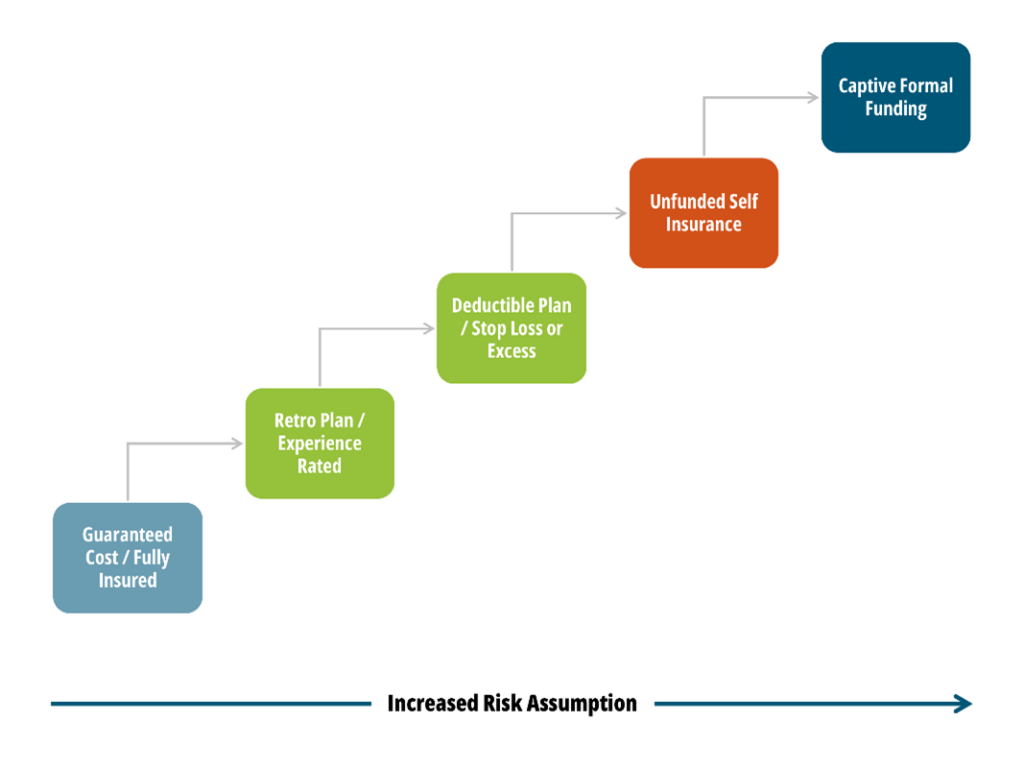

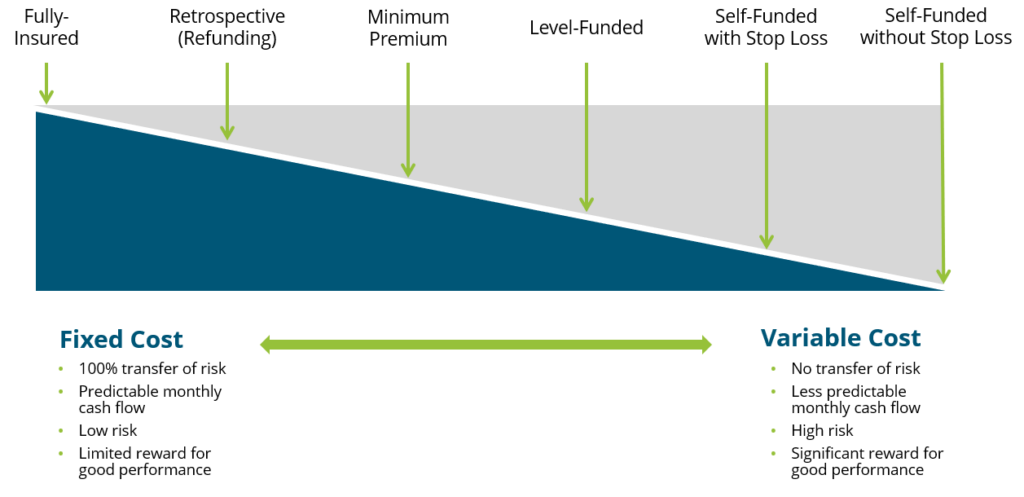

When it comes to benefits funding, the following graphic illustrates the spectrum of options available, where the risk taken by the employer increases as you move toward the right.

While a fully insured plan largely frees the organization of risk, there is typically a lot of overhead and administrative costs involved and less governance when it comes to claims management. Overall, though, we encourage our clients to consider this spectrum and determine where they fit in related to risk appetite, budget and resources, specific health trend, and more.

2. Financial Management

Related but separate from risk management comes the financial management of your benefits program(s). There are three key activities that fall within this bucket:

- Program Strategy

- Account for long-term costs and variability

- Cost Projections and Rate Setting

- Provide budget updates

- Adjust for economic changes

- Includes premium equivalent rate projections and employee contribution rate setting

- Plan Governance

- Establish framework

- Ensure sufficient reporting and monitoring cadence

- Account for actual versus expected, large claims reporting, key cost drivers, retiree medical valuations, etc.

The insights gleaned from the financial management arm should be embedded into your overall benefits and risk management strategy, rather than live in a silo.

3. Pharmacy

Pharmacy has been top of mind for employers, understandably so given the rapid rise in prescription drug costs, which now constitute anywhere from 20-25% of total healthcare spend in the U.S. Specialty medications account for 50% or more of pharmacy spend even though only about 2% of the population is using them. Brand and generic drug costs are also rising at rates we have not seen in the past, perhaps in correlation with inflation. Suffice it to say, employers are struggling to mitigate their own costs as well as the costs for their employees. So, what can be done?

Within the pharmacy benefits landscape, two areas have been getting a lot of attention: weight loss drugs and biosimilars.

Weight Loss Drugs

Chances are you’ve heard about a new wave of “Hollywood diet” drugs. There has been an enormous amount of marketing going on around these new weight loss drugs, especially in the realm of social media and influencers. All of the buzz has also gotten the attention of employers, who are asking us questions surrounding coverage, costs, and pros and cons.

To provide some background, of the four weight loss drugs taking center stage, only two have indications for weight loss, while the other two are being used off-label. Weight loss drugs are not new, but these varieties are showing results we haven’t seen before, and their arrival on the market is timely, as about 42% of the population is either overweight or obese.

From a health and productivity standpoint, we know that obesity increases a person’s risk of developing a chronic condition, which leads to higher healthcare costs. But we also know that there are financial and non-financial reasons to foster a happy and healthy workforce. Can and should weight loss drugs be an answer for employers?

These new drugs are retailing for about $1,300 a month, so we need to consider annual costs and the longevity of how long an employee will need to stay on the medication. For employers considering them to their plan, we recommend it being one piece of a comprehensive strategy that also includes wellness initiatives and/or a commitment from those prescribed the drug. In addition, you must build strong monitoring protocols to judge effectiveness and impact on overall plan costs and utilization.

The inclusion of weight loss drug coverage in a health plan will make sense for some employer groups, and not others. We recently talked with an employer client who saw enough value in even a 10% reduction in body weight to convince them to cover the drug. However, any decisions need to be based, once again, off of population data and corporate objectives. This is a new and evolving sector, so your strategy should remain fluid as we see developments.

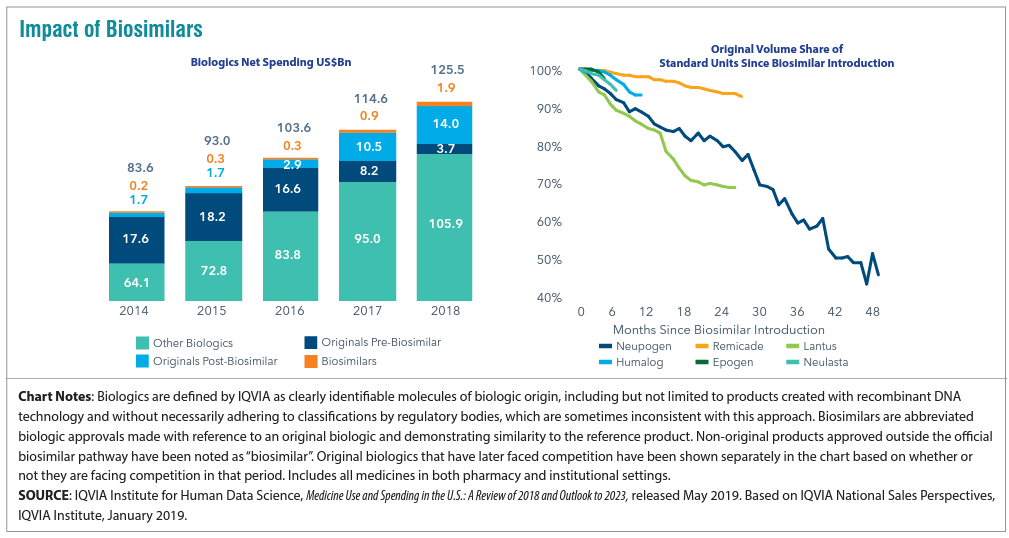

Biosimilars

Biosimilars are non-generic alternatives to those specialized medications that are very targeted in how they work and on what conditions they combat. There has been a lot of anticipation surrounding biosimilars as a solution to the specialty drug cost crisis. At the beginning of the year, a biosimilar of Humira, the number one drug dispensed in the U.S. which is used to treat inflammatory conditions, entered the market as the first biosimilar. While there has been some impact, to date it has not been the silver bullet we were hoping for. We can see below that biosimilar adoption rates are all over the map depending upon the condition for which it’s being utilized.

For employers, what’s important is vigilance in understanding where your Pharmacy Benefit manager (PBM) has positioned biosimilars as far as coverage is concerned. We have found that PBMs are placing biosimilars typically at the same parity with the reference, or brand name product. In this case both Humira and its biosimilar would be considered tier 3 medications, which does not yield the anticipated savings. Why is this? Well, there may be additional rebates available to employers and health plans if they continue to use the reference product.

This is a complicated space that continues to change at a rapid pace. Overall, though, if biosimilars are working the way we want them to, we need to figure out a way for all stakeholders to embrace them as a lower cost alternative instead of being locked into brand name drug prices. In some cases, the drugs are life-changing, so we do want to cover them but in a more sustainable way. We work with clients to ensure they are informed of and ready for these advancements and nuances.

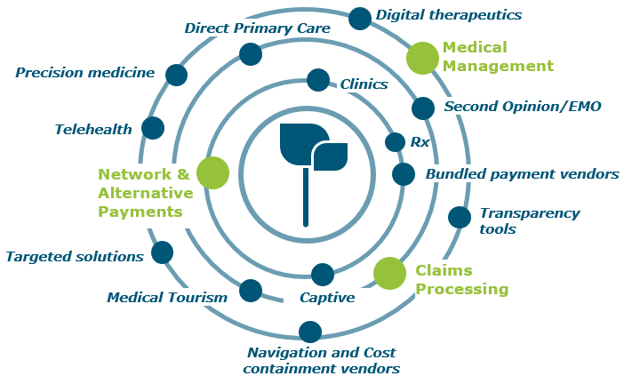

4. Targeted Point Solutions

The term “point solutions” now represents a large umbrella of tools, however it typically references programs that target specific diagnoses such as diabetes, oncology, and hypertension. In recent years there has been significantly more interest in point solutions from our employer clients, and, especially with multiple solutions running at a time, these can be a slow leak on spend. Now is a good time to take a step back to answer that risk versus reward question for point solutions.

The best place to start in assessing point solutions whose reward outweighs the risk is data analytics. Try to use any data you are getting from your health plan, internal teams, or the industry to benchmark your spend. In areas where your spend is high relative to benchmarks, do a deep dive for potential solutions that can help. Some pitfalls in this area include:

- The more point solutions you implement, the harder they become to monitor and manage

- Point solutions embedded in your health plan may seem like a no-brainer, but they usually yield very low take-up rates

- Overlap between different point solutions/benefits programs can cause confusion for all stakeholders

- Focusing purely on dollar ROI may not be the play; listen to your gut about what is right for your workforce and understand the qualitative advantages around camaraderie and culture to be gained

5. Absence Management

Absence management is highly correlated with your health plan performance, since the vast majority of your high cost claims will also include a leave of absence, so there are both plan costs and productivity rates at play here.

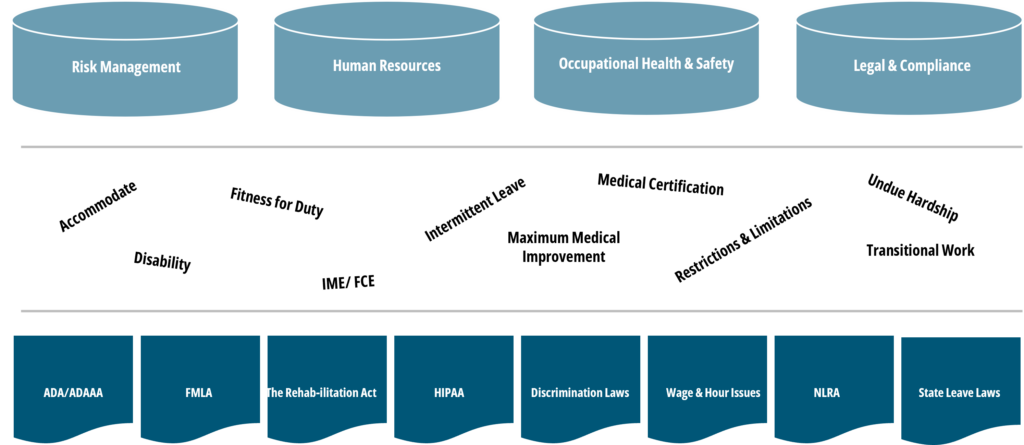

Making absence programs more challenging is the volume of stakeholders involved and laws with which you need to comply (as seen below).

Further, when we talk about absence management, we account for a wide range of benefits including short- and long-term disability, statutory disability, workers’ compensation, FMLA, ADA state paid family and medical leave (PFML), and others.

With absence, different than with medical plans, your company’s managers and supervisors are directly involved when it comes to plan design, governance, staff training, etc., so it is an area where you typically need to look inward to drive change.

When it comes to the risk/reward balance of an absence management program, employers can make sure corporate programs are set up the way they want, for example, promoting the right attraction and retention strategy. Remember that the more generous your programs are, the more they will cost and the higher the risk you take on. If shifting some responsibility to an outsourced partner, be sure you still have monitoring protocols in place.

Closing Thoughts

Across these five areas and more, we encourage you to get familiar with your organization’s plan and demographic data. Depending on your size, the level and depth of data available might be different, but there is always some data available, such as industry standards and benchmarks. Whether you are focused on weight loss drug strategy, funding, or point solutions, you can take those data-driven insights and apply them across these four pillars to determine your best practice.

If you are having trouble getting started, or could use specific guidance surrounding the topics mentioned, please get in touch with our team.

As we wrap up Mental Health Awareness Month, it was only fitting that the New England Employee Benefits Council (NEEBC) hosted their Annual Summit just a couple of weeks ago. Mental health awareness and wellbeing resources are top of mind for employers and HR teams across the nation, and, as we saw at NEEBC, specifically a focus in New England. Some additional hot button topics during the conference included:

1) Inflation/cost control strategies

Maneuvering around inflation and costly claims are top priorities for benefits professionals nationwide and was a constant topic of discussion by both presenters and attendees. The first keynote panel focused on the “Current Economic, Political and Cultural Landscape: Where We Are. Where We’re Going. Why It Matters.” They explored typical cost drivers, workplace trends (hybrid, remote, and on-site), and how HR teams can help preserve New England’s unique culture within their workforce.

2) Understanding the needs of your workforce

As many employers have shifted to remote and hybrid models, communication and understanding the needs of the workforce has been challenging for many. One session that really resonated with me included two benefits specialists from ZOLL Medical; they reviewed how benchmarking and survey data helped give their workforce a voice when it comes to their benefits. On the other side, they also looked at pitfalls and obstacles they faced initially and how they overcame them, and steps they took to optimize their survey process.

3) Promoting wellbeing and mental health

Finally, mental health and employee wellbeing continue to be top-of-mind at HR and benefits conferences across the nation. As mental health resources have become a mainstream benefit area, employers are now looking at alternative and new programs to stand out and retain/attract talent. A professor from Northeastern University’s Department of Health Sciences presented on social determinants and their impact on employee health and wellbeing. He leveraged his research to outline best practices and how HR teams can alter their offerings to fit the needs of a diverse workforce.

As a pharmacy consultant, I was excited to see the interest people had in Rx cost control tactics, PBM logistics, and specialty drug strategies. The costly and challenging landscape of pharmacy benefits should motivate employers to implement program changes; we can help. Here are some considerations and tools employers can utilize to address employee wellness, which, in turn has a direct impact on pharmacy costs. Thank you to NEEBC for another insightful event and we look forward to the next one.

As Seen on AleraGroup.Com

An aging population, medical advances that extend life expectancy and soaring costs for long-term care are the principal drivers of a problem too many Americans don’t consider until it’s too late: paying for care that standard health insurance doesn’t cover.

Consider:

- Multiple studies show that 70% of Americans over the age of 65 will need long-term care (LTC) in their lifetime.

- As of February 2020, LTC, which is not covered by traditional Health Insurance, cost an average of $6,844 per month for a semi-private room in a nursing facility and $7,698 per month ($92,798 per year) for a private room. Given post-COVID inflation, those figures, from LongTermCare.gov, are certain to be higher today.

- Medicare is restricted in scope and duration.

- Medicaid can provide limited assistance with LTC, but only for individuals who are eligible and, even then, only if their income and measurable assets are below a specified level.

Yet a survey released in July of 2022 found that only one quarter of adults between the ages of 40 and 64 with annual household income between $75,000 and $150,000 have or are even considering funding reserved for long-term care. Forbes reported on the survey in a piece titled “Most Americans Are Unprepared For Long-Term Care Costs, New Research Shows.”

That’s a headline as apt as it is ominous.

“Everyone should be having conversations with loved ones about wishes and needs,” Tom Beauregard, the CEO of the home healthcare service that co-sponsored the survey, told Forbes. “And from these conversations they should then be either earmarking a significant portion personal savings for long-term care needs or they should be enrolling in lower-cost policies to cover at a minimum one year of long-term care needs.”

LTC Learning Opportunity

Funding long-term care is the subject of the next event in Alera Group’s Engage series of employee benefits-focused webinars: What’s Coming Next With Long-Term Care Coverage? During the June 15 webinar, we’ll discuss:

- Long-term care options and costs;

- Financing solutions, including Long-Term Care Insurance (LTCi) and linked benefits, such as long-term care riders on Life Insurance and annuity policies;

- Why offering long-term care coverage as a voluntary, or specialty, benefit is a smart choice for employers;

- Legislation states are enacting or considering to create their own publicly or privately financed Long-Term Care Insurance programs.

Joining me on our panel of Alera Group experts on long-term care coverage will be Regional Compliance Consultant Bob Bentley; Shane Johnson, Senior Partner at Perspective Financial Group; and Tina Santelli, our Vice President of Voluntary Benefits and Enrollment Solutions.

Employers who offer or are considering LTCi as a benefit will want to learn the latest about this evolving coverage. Individuals, especially those approaching or past age 50, should be interested as well. As those studies about long-term care show, most of us are going to need it.

Awareness and Affordability

Why do so few Americans have or plan to purchase some form of long-term care coverage? Many don’t realize how expensive long-term care can be. Others aren’t aware of the restrictions on Health Insurance, Medicare and Medicaid. Some aren’t aware that Long-Term Care Insurance even exists.

But for even the best-informed, the matter simply comes down to price, and Long-Term Care Insurance is one of the more expensive personal lines of coverage. According to data from the American Association for Long-Term Care Insurance, average annual rates in 2020 were $1,700 for a 55-year-old man and $2,675 for a woman of the same age (with differing actuarial tables accounting for the variation in premium).

That said, here’s something else to consider: Typically, Long-Term Care Insurance activates when an insured is no longer capable of independently performing two activities of daily living (ADLs). Most Long-Term Care Insurance carriers recognize six ADLs:

- Bathing

- Continence

- Dressing

- Eating

- Transferring (e.g., moving from chair to bed)

- Toileting.

When you think about the type of facility or in-home service you’d prefer to provide you with such assistance once necessary, or when you realize the burden on family members called on to assist in those daily activities, the cost of LTCi may seem more reasonable.

It is a lot for an individual or couple to consider, and it requires an informed decision. For employers, offering coverage of long-term care – as either a paid or voluntary benefit — shouldn’t be nearly as difficult. Most employees surely would appreciate it.

We’ll discuss it further on June 15. I hope you’ll join us.

Background

With Ozempic in particular capturing headlines, a new generation of weight loss prescription medications have gained recent traction. According to the National Institute of Diabetes and Digestive and Kidney Diseases, more than 42% of American adults are obese or severely obese, a rate that has almost doubled since 19801. Although we remain a society hyper-focused on pant size, the potential health benefits of these medications should not be ignored.

The World Health Organization (WHO) reports that four million people die each year from underlying conditions related to obesity. Obesity has been known to increase your risk of developing type 2 diabetes, hypertension, cardiovascular disease, kidney disease, stroke, sleep apnea, osteoarthritis, and certain types of cancer, and can extend beyond the physical realm to negatively impact mental health as well2.

As employers and the nation work to combat soaring healthcare costs, obesity could be a critical piece of the puzzle since medical costs for the obese tend to be 30%-40% higher than those with a healthy weight3. A study by Xcenda estimates that if obesity rates in the U.S. were 25% lower, we would see a 115% decrease in IUC admissions and deaths related to COVID-194.

We all know that losing weight is not as simple as it sounds. In addition to your average obstacles, social determinants of health such as income, education, location, and food insecurity, as well as genetics and hormones play big roles in the obesity equation and should not be minimized. Although a magic pill rarely exists, it is possible these new drugs could be perceived by some as magical.

To sprinkle some of that magic without too much smoke and mirrors, employers can ensure their health plan and Pharmacy Benefit Manager (PBM) partners have the right policies and eligibility criteria in place to ensure these medications are available for the right people.

The Basics

Two drugs, Wegovy (semaglutide) and Saxenda (liraglutide) both manufactured by Novo Nordisk have FDA indications for weight loss. Trials for Wegovy and Saxenda produced 15% and 5-10% average weight loss results, respectively5. Although positive, the sample is small, and the long-term impact is unknown. Novo Nordisk’s marketing campaign created a frenzy, resulting in a national shortage of the drug. In 2022, Wegovy prescriptions increased by 284%6. The demand is so high, in fact, that Novo Nordisk is now prioritizing the limited supply to existing patients, making it harder for new patients to start the medication. Saxenda (liraglutide), which hit the market in 2015 experienced success, but preference has since shifted to Wegovy due to its once weekly injection and more robust weight loss potential.

Ozempic (semaglutide), also produced by Novo Nordisk, and Mounjaro, through Eli Lilly, are both currently approved for diabetes but are seemingly being used off-label for weight loss. Industry leaders believe Mounjaro, which is said to give off an even stronger fullness signal and reports even more weight loss than Wegovy. The initial results are positive with favorable weight loss in 80% of patients taking Mounjaro and average weight loss at 15%, based on information from The New England Journal of Medicine. It is expected the drug will be approved for weight loss later this year.

Side effects for these drugs do exist, although relatively mild, include nausea, vomiting, diarrhea and acid reflux. The good news is that that with time these side effects typically subside. Patients may also experience pain at the injection side, dizziness, or fatigue. There is a general warning with the GLP-1 receptor agonists drugs regarding the risk of thyroid tumors7 in specific populations. Individuals should work with their physician to evaluate their appropriateness for the drug.

Contrave is another weight loss drug produced by Orexigen Therapeutics that was approved for weight loss in the U.S. in 2014. Contrave is approved for people with obesity (a body mass index of 30 or more, or of 27 or higher with at least one weight-related condition). Contrave, an oral tablet, is a combination of two active ingredients, naltrexone and bupropion, which together work to suppress appetite and increase the feeling of being full after eating. Clinical trials report that Contrave can lead to a loss of 4%-8% of body weight. Similar Rx benefit policies and restrictions are in place but provide an alternative to patients.

Many medical experts recommend long term therapy for patients but with evidence still emerging recommendations are changing quickly. It has been reported that most people gain the weight back after stopping8 which would likely result in an endless cycle. While these drugs do yield hope, they still are not a silver bullet, and ideally would be one piece of a comprehensive health betterment plan that also focuses on healthier eating and exercise habits9.

The Numbers

These medications have high price tags with Wegovy retailing at approximately $1,300 a month and lack of coverage without strict prior approval criteria. Even with the high price tag, some patients are willing to cover the cost out of pocket and can find manufacturer programs to offset some of their costs. This industry has a projected market value of approximately $100 billion in less than ten years. Reuters reported on March 29, 2023, that WHO is considering adding obesity drugs to their ‘essential’ medicines list, but this remains to be seen.

If we know that obesity rates are linked with environmental, generic, and social determinants of health, only a tiny piece of the epidemic can be mitigated with these drugs which does not serve as an equitable solution. In that vein, we are keeping our eyes on the proposed bill entitled the Treat and Reduce Obesity Act, which could alter insurance requirements for obesity treatments like these, but carriers may hold out until long-term effectiveness can be proven.

It is worth nothing again that only Wegovy, Saxenda, and Contrave are currently authorized for weight loss alone, but there is evidence that other versions of the drug (i.e. Ozempic and possibly Mounjara) are being used off-label for weight loss by non-diabetics.

Employer Considerations

As I mentioned, many insurance carriers only cover medications in this category in the case of diabetes. However, a survey conducted by the International Foundation of Employee Benefit Plans (IFEBP) states that 22% of employers in the U.S. cover prescription drugs for weight loss, and 32% offer weight management programs. This is driven by the fact that 25% of employers report obesity as the largest detriment to healthcare costs.

Given this, it’s likely important for employers – at least self-insured employers – to consider a formal but flexible policy related to weight loss medication as research evolves. A thoughtful program must consider all options available and pinpoint if these medications will positively impact your population and plan costs. A comprehensive policy will likely require prior authorizations, potential lifetime maximums and perhaps coverage in collaboration with other treatments (i.e. nutritionist, diet programs, workout routines, etc.). In addition, coordination with your pharmacy benefit manager will be critical to ensure you can take advantage of competitive pricing and rebates where appropriate.

Conclusion

Excess weight can take a hefty toll on a person’s body and mind. It can lead to serious health conditions which can lead to premature death, substantial disability, and/or negatively impact memory and mood. The fact is that obesity diminishes almost every aspect of health and the charge to “lose weight” or “maintaining a healthy weight” is frankly daunting. It is also very frustrating that the high costs of these medications are often cost prohibitive for many and inappropriate prescribing does not help our efforts to “reign in” pharmacy costs.

As employers we must look at the entire picture; both short- and long-term goals and educate ourselves on what coverage really looks like with our medical and PBM partners. We have a responsibility to ensure they have criteria in place to closely monitor authorization and utilization of these medications so to ensure the right person has the right drug at the right time and continues to benefit from it over time. Spring is happy to be the conduit for your organization in analyzing population health data, evaluating coverage options, ensuring the appropriate protocols are in place, and working with your PBM to build a strategy for prescription weight loss drugs into your larger benefits program.

1 Obesity Statistics. The European Association for the Study of Obesity.

2 https://www.webmd.com/diet/obesity/obesity-health-risks

3 Public Health Considerations Regarding Obesity. StatPearls

4 https://galen.org/2023/new-treatments-for-obesity/

5 https://www.nbcnews.com/health/health-news/weight-loss-drug-affordability-rcna60422

6 https://www.usatoday.com/story/news/health/2023/03/22/ozempic-wegovy-mounjaro-weight-loss-medications-explained/11510967002/

7 https://www.npr.org/sections/health-shots/2023/01/30/1152039799/ozempic-wegovy-weight-loss-drugs

8 https://dom-pubs.onlinelibrary.wiley.com/doi/10.1111/dom.14725

9 https://www.hsph.harvard.edu/obesity-prevention-source/obesity-consequences/health-effects/