Regardless of the specific line of coverage, claim audits are a best practice for employers and plan sponsors to ensure accuracy, identify errors, and document process gaps. A comprehensive claims audit can uncover issues related to compliance, adherence to contractual provisions, and consistency with best practices.

While most employers and plan sponsors understand the value of a claim audit, it is common to struggle with knowing where to start, and more specifically, when to start. For clients looking to audit their disability claims, we recommend considering the following factors in determining an optimal timeframe:

1. Vendor Implementation

If you are implementing your fully-insured disability plan with a new carrier or your self-funded disability plan or program with a new claim administrator, conducting a claim audit after the go live date can ensure that:

- Workflows established during implementation are being properly followed

- The vendor is correctly managing claims through the entire claim cycle

- Any areas where additional training or communication would be beneficial are flagged

Conducting a claim audit post-vendor implementation can help solidify the foundation for the relationship and serve to identify opportunities for improvement before they grow into more significant roadblocks as the volume of claims increases.

2. Renewal & Stewardship

Whether you have a vendor administering your self-funded disability plan or program or a carrier insuring your fully-insured plan, it may make sense to conduct a claim audit in anticipation of your renewal, allowing you greater insight into:

- Any process or performance issues that need to be addressed

- The financial implications of any findings of non-conformance

- Whether any performance guarantee should be added as part of the renewal negotiation to address a specific area of concern identified by the audit

As your team comes to the table to advocate for a fair renewal, audit findings can be a powerful negotiation tool. They can be used not only to position your organization for a more favorable renewal, but also as leverage to correct those findings that have had a negative impact on the plan or program’s financials and/or your employees’ experience.

3. Compliance

When determining the right time for a disability claim audit, if your plan is subject to The Employee Retirement Income Security Act (ERISA), your fiduciary duties may drive your decision to conduct an audit. As the plan sponsor, your organization is a fiduciary and must act prudently. An audit is one way to fulfill your fiduciary duty to act prudently as it not only monitors your vendor’s performance, but also ensures that the plan is in compliance with ERISA, the Internal Revenue Code, and other applicable laws.

4. Trend

Most employers receive some type of regular reporting and claims analysis from their vendor partners. When considering a claim audit, pay close attention to the data you are receiving, and consider setting things in motion if your plan or program’s experience is yielding an unexpected or new trend. In doing so, the claim audit can:

- Validate whether the trend is real and/or significant

- Identify the root cause of the shift in trend to inform potential strategies for mitigation or reversal

5. Self-Funded, Self-Administered

If you have a self-funded disability plan or program which you manage inhouse, you may want to consider establishing a routine cadence for conducting an audit of your team’s claim handling to:

- Validate that insourcing is still the right path for your organization

- Determine if there are any areas of opportunity for improvement and efficiency

- Confirm that your workflows and controls are being properly followed and applied

- Identify if there are any compliance issues

Conclusion

Disability claim audits should be one tool in an employer’s toolbox for ensuring compliance, vendor and internal performance, and an overall positive claim experience for your employees. In conducting a claim audit, employers need to determine stakeholders involved, resources (internal or external), data gathering methods, goals, and processes. While the ideal time may vary by employer, the question of when to conduct the audit is another integral component of your claim audit strategy and should not be overlooked.

If you are interested in conducting a claims audit but need guidance or an objective partner to assist, please get in touch with the Spring team.

Spotlight on Cancer Point Solutions: Supporting Employees with Targeted Innovations

In today’s rapidly evolving healthcare landscape, cancer remains one of the most complex and challenging conditions to treat and is a top cost driver for many employers, including colleges and universities. Thankfully, advancements in cancer care are offering hope and transforming patient outcomes. One of the most promising developments is the rise of cancer point solutions, which aim to address the specific needs of cancer patients through targeted interventions and comprehensive care models.

What Are Cancer Point Solutions?

Cancer point solutions are specialized programs or services designed to address key aspects of cancer care, from prevention and diagnosis to treatment and survivorship. These solutions often combine cutting-edge technology, personalized care, and multi-disciplinary approaches to improve patient outcomes and enhance the overall healthcare experience.

Why Are They Important?

Traditional cancer treatment often involves navigating a fragmented system of specialists, treatments, and services. Cancer point solutions are designed to streamline these touchpoints by offering a holistic approach that integrates various aspects of care. These areas may include:

- Early Detection and Screening: Advanced diagnostic tools and AI-driven screening methods improve the chances of detecting cancer at its earliest, most treatable stages.

- Personalized Treatment Plans: Leveraging genetic testing and precision medicine, cancer point solutions can tailor treatments to the unique genetic profile of each patient, improving efficacy and reducing side effects.

- Patient Support and Navigation: Dedicated care teams, including patient navigators, help guide individuals through their cancer journey, ensuring they receive timely care, emotional support, and access to necessary resources.

- Holistic Care Models: Integrating mental health, nutrition, and survivorship programs helps address the broader impacts of cancer, providing patients and their loved ones with the comprehensive support they need for both physical and emotional recovery.

Benefits to Patients and Providers

Cancer point solutions offer several advantages to both patients and healthcare providers:

- Improved Patient Outcomes: By leveraging innovative treatments and technology, cancer point solutions can lead to more successful outcomes, fewer hospital readmissions, and improved quality of life for patients.

- Cost-Efficiency: Early detection, personalized treatments, and streamlined care processes can reduce unnecessary treatments and hospital visits, ultimately lowering overall healthcare costs.

- Enhanced Care Coordination: With all aspects of cancer care integrated under one solution, providers can collaborate more effectively, reducing the risk of miscommunication and errors in treatment and improving the patient experience.

How Cancer Point Solutions Are Shaping the Future

As healthcare systems continue to adopt value-based care models, cancer point solutions may play an increasingly important role in optimizing care delivery. By focusing on both clinical and holistic outcomes, these solutions not only enhance patient care but also align with broader goals of improving efficiency and contributes to a holistic employee benefit model to support employees at various points in their lives.

Conclusion

While many cancer patients may have access to certain benefits through their providers and care teams, providing additional support through an employee benefit solution can give employees seeking care or caregivers supporting their family members additional resources and tools during a difficult time. By embracing these innovative models within a benefits program, employers can help their employees access more personalized, coordinated, and effective care, ultimately improving the lives of those affected by cancer and positively impacting organizational population health.

For more information on how our health and welfare consulting team can help you implement or optimize cancer point solutions within your organization, please contact us today.

1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8634312/

2 https://www.cancer.org/#:~:text=The%20American%20Cancer%20Society%20offers,patients%2C%20families%2C%20and%20caregivers

3 Improving Modern Cancer Care Through Information Technology

4 Patient-Centered Cancer Treatment Planning: Improving the Quality of Oncology Care. Summary of an Institute of Medicine Workshop

Workforce populations tend to be diverse in terms of demographics as well as other factors such as geography. This is one of the primary reasons healthcare programs are aligned with and sponsored by employers. These programs aim to achieve high enrollment to accommodate the demographic diversity among members. This, in turn, creates a system where the highest utilizers are subsidized by the leanest. There are several typical drivers that affect utilization: age, gender, morbidity, family size, etc. For mature populations participating in employer-sponsored healthcare programs, new hires with more favorable demographic characteristics help offset rising costs for aging employees, providing a consistent balance between those subsidizing and those being subsidized.

One of the largest demographic drivers of cost is age. As age increases, so do costs. When a population has aging members staying on well beyond 65, it becomes difficult to maintain the same influx of younger members to offset these rising costs. There are many industries where employees tend to work beyond age 65, such as education, public administration, and real estate. Additionally, due to rising retirement costs and increases in the cost of living, it has become necessary for many individuals to work beyond the traditional retirement age. The result is an average age that dramatically increases over time and average plan costs that outpace already burdensome medical and pharmacy trend rates.

How can we control these ongoing costs?

In general, there are many levers typically used to control healthcare costs. Many of them still make sense in the present environment, though they may be unattractive in a competitive employment situation. Examples include increased employee cost-sharing, leaner healthcare offerings, more stringent participation requirements, disease management, utilization management, and leaner pharmacy formularies.

How can we specifically address older members?

In the case of consistently increasing average age, these cost-control approaches may be temporary and insufficient. Further steps may include such approaches, but employers may also seek to decrease the number of older members remaining enrolled in the plan. Some specific suggestions include:

- Salary-banded employee contributions – This involves charging scaled contributions to members based on salary ranges. While this will not directly address older members, they tend to have higher salaries.

- Enrollment in Medicare – Increased Medicare enrollment could significantly mitigate post-65 costs. One potential approach, though often considered unattractive, is to move to a leaner pharmacy benefit for the active plan. If the pharmacy benefit is not as generous as contemporary Medicare Part D benefits, Medicare-eligible members will have to enroll in Medicare or pay a scaled penalty when they eventually do register, based on the number of months they were not enrolled.

- Offer an active stipend or payout – Some employers offer an annual or monthly stipend for not enrolling in an employer-sponsored plan, which may encourage members to seek coverage elsewhere. It could also make sense to offer a one-time lump-sum payout to help partially cover some of the estimated $165,000 (per Fidelity1) per individual for post-retirement healthcare costs.

- Offer post-retirement medical – One reason members remain in the workforce into later years is the challenge of acquiring and affording medical benefits after retirement. A post-retirement medical benefit is a large and expensive undertaking, but there can be more controllable mechanisms that limit costs to predictable amounts. A specific example is a defined contribution-type plan, where an explicit subsidy helps offset ongoing costs. This can be based on various factors to yield a predictable set of costs.

In summary, mitigating the increase in medical and pharmacy costs over time is already a significant challenge for employers, and aging populations can exacerbate these increases. It’s important for employers to address these issues head-on or face financial headwinds that could impact their stability. Please reach out to our team to explore these solutions further.

In recent years, a new term, carewashing, has emerged in discussions about workplace culture and employee benefits. The concept reflects a growing concern that companies are superficially adopting caring practices and policies—often as part of their branding—without genuine commitment. Modern employers aiming to foster authentic and supportive workplace environments should reflect on this term and how it relates to their positioning with their external clients as well as their employees.

When we shine a spotlight on employee benefits, carewashing refers to the practice of companies presenting themselves as caring and employee-focused, without implementing substantial, changes that truly benefit employees. In some instances, employers may implement meaningful programs, but since employees are unable to take advantage of them due to cultural limitations they are still viewed as carewashing. For example, a company might promote its new mental health day policy or wellness app extensively but fail to address systemic issues like excessive workloads, inadequate mental health resources, or poor management practices. The result is a veneer of care that can mislead both current and prospective employees about the organization’s true commitment to well-being.

It is imperative that organizations work to combat carewashing because of the impacts it can have on the business, employees, and their families.

- Genuine care and support for employees are critical for building trust and engagement. According to Gallup, organizations that show true commitment to their employees’ well-being experience higher levels of engagement and lower turnover rates1

- When employees recognize that initiatives are merely cosmetic, McKinsey & Company indicates it can not only lead to disengagement and turnover, but reduced productivity as well

- Negative perceptions about carewashing can damage a company’s reputation, making it harder to retain and attract top talent. A Harvard Business Review article highlights that companies perceived as inauthentic in their employee care practices can face significant reputational damage

- Although on the surface carewashing is not illegal, it could lead to legal risks (e.g., promoting care but not giving adequate support) and certainly presents ethical concerns

To mitigate the risk, employers must self-reflect and talk openly about their approach to employee benefits, ensuring their programs reflect their culture and vice versa. In some instances, offering programs without cultural support may do more harm than good. Using these guiding principles will go a long way to reduce the risk of carewashing:

- Set a holistic approach considering mental, physical and financial health

- Focus on implementing highly effective programs, invest in understanding the impact and align solutions with employee needs while considering business impact (positive and negative)

- Involve front line managers in roll-out campaigns to convey the importance of the program, understand their concerns and work together to find solutions

- Work toward a culture of caring that includes training and advocacy. If that is not possible in your organization, pinpoint solutions that can be genuinely adopted, appreciated and accepted

- Be transparent; every organization is unique. It’s better to make incremental, successful change than provide an offering that provides little to no value to employees and creates reputational risk for the organization

Although the terminology will change, any program design that undermines the trust of employees or clients will lead to disengagement and dissatisfaction. Make sure the programs you implement within your benefit offering do not mislead employees. Employees often tap into employee benefit programs during some of the direst times in their lives; nobody wants to feel carewashed when what they really need in that moment is care.

If you could use objective guidance on building and prioritizing realistic benefits initiatives, or evaluating your current state for carewashing red flags, please get in touch with our team.

1 Witters, Dan. “Showing That You Care About Employee Wellbeing.” GALLUP. https://www.gallup.com/workplace/391739/showing-care-employee-wellbeing.aspx

In August 2022, the Inflation Reduction Act (IRA, P.L. 117-169) was signed into law, bringing significant changes to Medicare. The law expands benefits, reduces drug costs, and improves the sustainability of the program, providing meaningful financial relief to millions of Medicare beneficiaries by enhancing access to affordable treatments1.

For the first time, Medicare now has the authority to directly negotiate the prices of certain high-cost, single-source drugs that lack generic or biosimilar competition. This groundbreaking provision is designed to help control costs and ease the financial burden on both the program and its participants.

Medications Selected for Price Negotiation

The Centers for Medicare & Medicaid Services (CMS) identified the initial group of drugs for negotiation based on multiple criteria, including the drug’s cost and the number of Medicare Part D enrollees currently using them. CMS engaged in direct negotiations with drug manufacturers to secure lower prices for some of the most expensive brand-name medications.

This negotiation process includes CMS presenting a final offer to the manufacturer, which can either accept or reject the proposal. The outcome? CMS and participating manufacturers have finalized pricing agreements, with Maximum Fair Prices (MFP) for ten selected drugs set to take effect on January 1, 20261,4.

This initiative is part of a broader, multi-year effort. By February 2025, CMS will select up to 15 additional drugs covered under Medicare Part D for negotiation, with new prices projected to be implemented in 2027. Another 15 drugs will be chosen in 2028, and an additional 20 the following year, expanding the reach of negotiated price reductions as required by the IRA4.

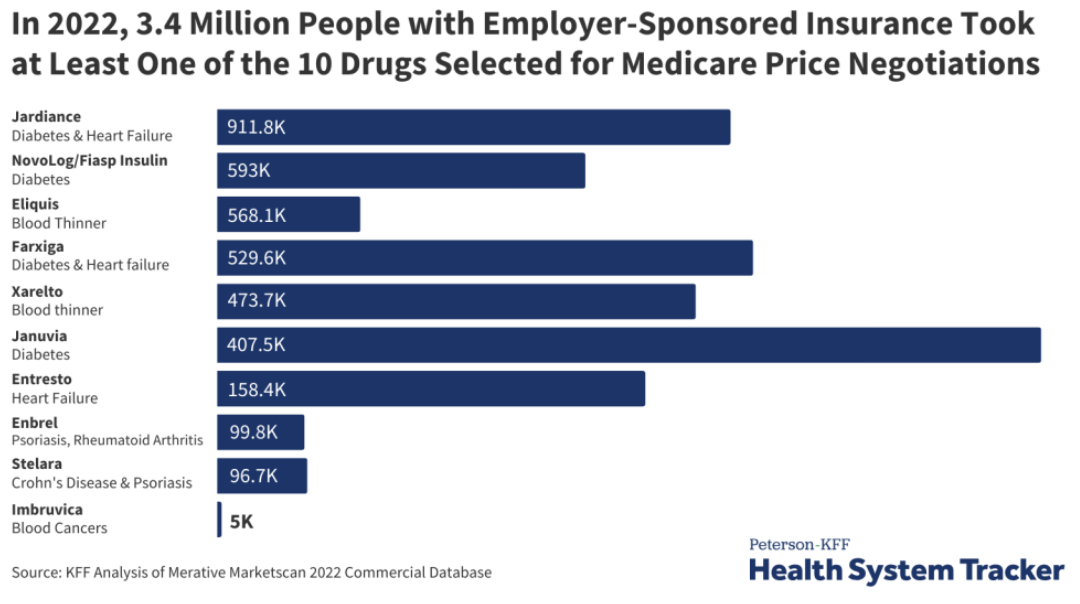

Although the Medicare drug price negotiations don’t apply to private insurance, 3.4 million people with employer coverage take at least one of the selected drugs. The ten medications are listed in the below graph3.

How Does This Affect Commercial Insurance?

Although these Medicare negotiations do not directly apply to private insurance, they could still have ripple effects on commercial drug pricing. Currently, 3.4 million people with employer-sponsored coverage use at least one of the drugs selected for negotiation3.

The impact on commercial insurance remains uncertain. Some experts suggest that lower Medicare prices could result in higher costs for private insurers as manufacturers look to recoup losses. Conversely, others believe that the negotiated Medicare prices could serve as a benchmark, potentially leading to lower prices in the private sector as well3.

While it’s too early to tell how private insurance will be affected, the ongoing Medicare drug price negotiations will be a closely watched development in the healthcare landscape.

To stay updated on this topic and learn more, click here.

1 Negotiating for lower drug prices works, saves billions. CMS. August 15, 2024. Accessed September 13, 2024. https://www.cms.gov/newsroom/press-releases/negotiating-lower-drug-prices-works-saves-billions

2 https://www.ajmc.com/view/lower-drug-prices-announced-under-medicare-negotiation-program

3 https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/

4 https://www.cms.gov/inflation-reduction-act-and-medicare#:~:text=The%20Inflation%20Reduction%20Act%20makes,and%20limiting%20increases%20in%20prices

On September 1, 2024, we celebrated a significant milestone: the 50th anniversary of the Employee Retirement Income Security Act (ERISA). Signed into law by President Gerald Ford on September 2, 1974, ERISA has quietly yet profoundly impacted the lives of countless Americans, ensuring that promises made regarding retirement and health care benefits are promises kept.

ERISA: A Commonly Overlooked Law That Impacts You

While the average American may not recognize the name, ERISA likely plays a crucial role in their lives. This landmark legislation sets minimum standards for most established retirement and health plans in the private sector, providing essential protections for plan participants and beneficiaries in employee benefits plans. From safeguarding retirement savings to ensuring that benefits regulations and requirements are adhered to, ERISA has been a cornerstone in the benefits industry for the past five decades.

A Journey Through ERISA’s History¹

The story of ERISA began with a series of broken pension promises that left thousands of employees without the benefits they were owed. The most notable case was the closure of Studebaker’s South Bend, Indiana plant in 1963, where workers were denied the pensions they were promised. This incident, among others, underscored the urgent need for pension reform and captured the public’s attention.

In response, President John F. Kennedy created the President’s Committee on Corporate Pension Plans in 1961, which issued its report in 1962. Senator Jacob Javits introduced pension reform legislation in 1967, and the momentum continued to build, especially following the release of the 1972 Peabody Award-winning documentary, Pensions: The Broken Promise. Public hearings were held, legislative efforts advanced, and finally, the Employee Retirement Income Security Act was signed into law in September 1974.

Senator Javits, the principal sponsor of ERISA, described it as “the greatest development in the life of the American worker since Social Security.” ERISA has shaped how employers provide retirement and health benefits, working behind the scenes to set standards that protect millions of workers and their families. ERISA was passed by the House in a vote 407 – 2 and unanimously approved in the Senate demonstrating how united the country was behind this important piece of legislation.

The Evolution of Employee Benefits and Captives

ERISA’s influence extends beyond traditional employee benefits. Over the years, there has been notable growth in employee benefits provided through captives—specialized insurance companies owned by the businesses they insure. This trend has enabled companies to have greater control and flexibility over their benefits offerings while managing risks more efficiently. Not all benefits are subject to ERISA, as seen below, but if they are, they need to go through a filing process with the Department of Labor (DOL) to receive a prohibited transaction exemption (PTE). The goal of the PTE process is to ensure that the interests of plan participants in the captive model are still protected, through an additional layer of DOL oversight surrounding fair pricing and compliance.

As captives grow in popularity, they provide new opportunities for employers to offer competitive, tailored benefits while achieving cost control—a trend ERISA has helped enable by providing the regulatory framework necessary for captive expansion and innovation.

Looking to the Future: ERISA’s Continued Relevance

Fifty years on, ERISA remains as relevant as ever. A recent example of ERISA’s modern influence is the tentative approval given by the DOL to leverage a captive to fund pension plan risk for the first time. This development benefits both plan sponsors (employers) grappling with pension plan liability and benefits recipients.

As we navigate new challenges in the benefits landscape—from evolving retirement needs to the complexities of modern healthcare—ERISA provides a foundation that ensures the rights and protections of millions of Americans are upheld.

1 https://www.dol.gov/agencies/ebsa/about-ebsa/about-us/history-of-ebsa-and-erisa

Every industry has its own challenges and nuances. Since our client base is widely varied, we routinely partner with our clients to tackle unique, industry specific obstacles as they build out customized employee benefit programs and strategies. When it comes to the airline sector, a specific pain point relates to adequate long term disability coverage for their licensed pilot employees.

Background

Pilot union contracts typically require airlines (the employer) to provide long term disability (LTD) insurance to their pilots, but this coverage has become nearly impossible to procure in the traditional LTD market, for a range of risk reasons:

- Volatility and financial hardships in the airline industry, with bankruptcies and federal bailouts not uncommon

- Pilot unions, such as ALPA, APA, and SWAPA, can be litigious in fighting for their members, making pilots less favorable in the eyes of insurance carriers

- Federal Aviation Administration (FAA) oversight regarding the fitness of a pilot complicates claims processes

- The nature of the job poses special risks, including:

- Consistent exposure to high altitude

- Safety considerations

- Prone to illness or injury due to physical and mental demands

Pilots are humans like the rest of us, but given the stressful nature of their job and the consequences of their environment, they might be in greater need of LTD coverage than the average worker. For example, the FAA estimates the prevalence of substance misuse is 8.5% among pilots, with other sources placing that rate as high as over 15%1.

Sensibly, the FAA’s regulations around pilot licensing are very stringent, so there is a large risk that a pilot will lose their license over a medical condition, including the substance issues referenced above. As a result, the gap in the market for conventional LTD coverage has yielded a specialty market specific for pilots, which is based on the loss of a pilot’s license instead of the traditional definitions of disability, which are based on the ability to perform either the material and substantial duties of one’s own occupation or any occupation which could be reasonably expected to perform in light of their background. Since these loss of license plans are generally structured either as a monthly benefit while a pilot is grounded or as a lump sum, pilots who do not lose their license essentially have no product option available that provides income replacement as a traditional LTD plan would. In addition, even when the specialty coverage would provide a benefit, it is limited in availability and, with very little competition, premiums are high and there is minimal, if any, room for customization.

Potential Solution

At Spring, we often say that captives are the whiteboard of insurance, meaning that they can be leveraged and crafted in a diverse range of ways to solve for unique and evolving challenges. LTD coverage for pilots can be added to that whiteboard.

Most airlines currently have a captive insurance company, which they may only be utilizing for property and casualty (P&C) lines of coverage. Even when an airline does have employee benefits in their captive, they are typically not leveraging the captive for long term disability insurance or other voluntary benefits.

Long tail risks such as disability are particularly beneficial for captives. Traditionally, when premiums are paid to carriers they hold and maintain any investment income earned on reserves. When funding these long-term liabilities through a captive, the investment income earned is held until the time of loss and stays within the captive. These investment returns are substantial and serve as yet another benefit for placing disability coverages into the captive.

Having employee benefits (including LTD) in a captive provides the following advantages:

- Cost savings and improved cash flow

- Increase cost certainty and support budgeting

- Reduce operating costs

- Control over underwriting and funding

- Flexibility in terms and conditions

- Better claims management

- Improved access to data

The biggest benefits for airlines placing LTD through their captive program is creating greater control of customization of coverage and are less susceptible to market volatility and pricing by moving away from the commercial market.

Having a combined P&C and employee benefits captive program, which incorporates LTD, would further strengthen the airline’s overall captive and risk management strategy by offering risk diversification, since LTD risks are unrelated to the existing P&C risks underwritten in the captive. Along with projected increased profits of the LTD line of coverage, this approach increases the number of statistically independent exposures, which improves the stability of the overall program. In addition to LTD, medical stop loss could also be added to the captive to protect against catastrophic claims and create more predictability.

Action Plan

LTD insurance for pilots has been an issue for years in the airline industry, and no optimal commercially available solution has come forth. Captive insurance has long been a strategic approach to niche or especially challenging insurance obstacles and essentially how and why captives were born. The LTD commercial market is prime for disruption, and for those willing to move towards a more flexible and beneficial program, a captive insurance company can provide an answer.

The absence management conversation is a critical component of every employer’s broader employee benefit strategy discussion these days, especially given the competitive talent market and the rapidly evolving regulatory landscape surrounding leave of all types and at all levels (federal, state, local). Now, more than ever, employers and employees need to understand how all available benefits, including supplemental health plans, such as Accident, Critical Illness, and Hospital Indemnity, work together. Compliance isn’t the only consideration, though. Employers need to be sure not to duplicate processes which can increase costs as well as to ensure a smooth and positive employee experience.

Understanding supplemental health products and the benefits provided by them ensures that those paying for the coverage will fully utilize the benefits available. Since Accident, Critical Illness, and Hospital Indemnity benefits are paid when an accident occurs, a critical illness is diagnosed, or a hospital stay is required due to injury or illness, they offer a way to fill in the financial gaps left by traditional health insurance, disability coverage, and paid leave benefits. The lump sum benefits paid by the supplemental health plans can be used to cover out-of-pocket expenses like medical copays and deductibles, as well as to supplement the income replacement benefits provided by paid leave and/or disability plans.

The good news is that insurance carriers have made significant progress over the last few years toward the integration of absence and supplemental health products.1 Many are, now, not only bundling supplemental health products with their core disability and absence products and offering a package discount to the core products when quoting, but also tackling the more complex issue of how to ensure that employees enrolled in supplemental health plans are receiving the financial benefit of the products they pay for with payroll deductions.

To ensure that supplemental health plan participants receive the benefits they are entitled to under their policies, most carriers are digging into questions like:

- How can they identify disability and leave claimants who are also enrolled in one or more supplemental health product(s)?

- Is there a way to leverage the claim information obtained during the leave and disability claim process(es) to pay supplemental health claims without having to request redundant or additional medical information?

Carriers are also reviewing their processes to find efficiencies and create a better claimant experience. This internal retrospection has led to things like coordinated leave, disability, and supplemental health claim intake and the sharing of medical information across all claims. Many carriers are not only building out coordinated claim paths and workflows for leave, disability, and supplemental health claims, but they are also having their leave and disability claim specialists conduct routine analysis of current leave and disability claim files to see what other coverages an insured is eligible for and whether the medical information on file could be used to adjudicate the corresponding supplemental health benefit claims. Some carriers who have access to medical claim files offer auto-generated notifications, which are sent to supplemental health plan participants, reminding them of their supplemental health benefits based on the medical claim data. Software and technology companies as well as third-party administrators (TPAs) who often handle leave benefit administration are also focused on product improvements in the areas of artificial intelligence (AI), automations, self-service portals, communications, intake, and reporting. All these claim process adaptations alleviate steps for the insured and make it easier, overall, for them to know what benefits are available and be able to utilize them. They also help claimants to maximize the value of the benefits for which they are paying and enhance the customer experience that is top of mind for employers of all types, sizes, and industries.

1 Spring Consulting Group. 2022-2023 Integrated Disability, Absence, and Health and Productivity Vendor Benchmarking Survey.

In a recent podcast from Global Captive Podcast, president and CEO of edRISK, Tracy Hassett, and our SVP, Prabal Lakhanpal, dive into the history of edRISK and how educational institutions have been able to leverage a captive to reduce health insurance costs and reduce liability. You can find the full podcast episode here.