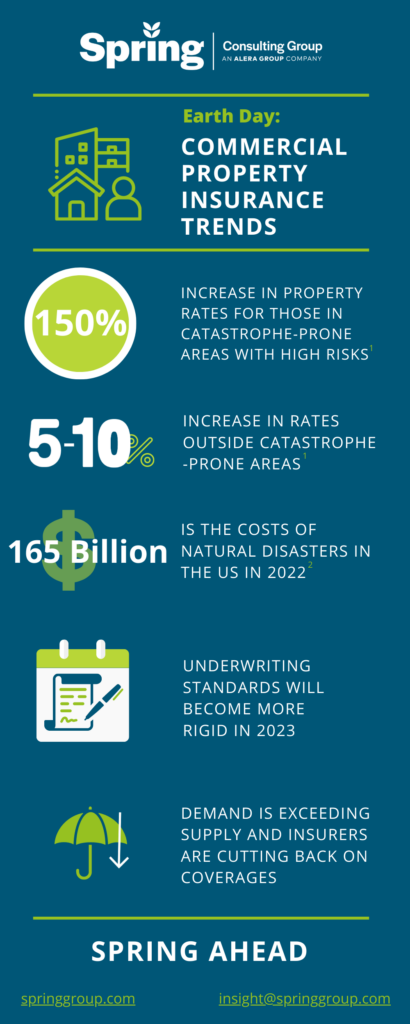

This Earth Day, we wanted to highlight the effects of climate change and natural disasters on the property & casualty insurance industry. Check out the infographic for a quick glimpse of where things stand.

Sources:

1 Alera Group’s 2023 P&C Market Outlook + Commercial Property Update

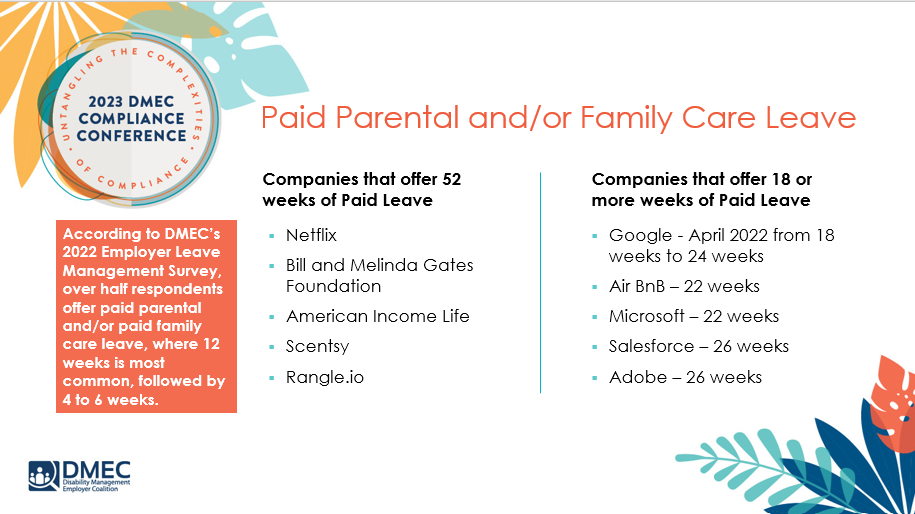

As we progress through 2023, maneuvering changing regulations and compliance updates have been challenging for HR professionals across the nation. Many COVID-19 provisions are expiring soon, states are constantly shifting paid leave policies and managing hybrid/remote workforces are just a few hurdles employers are facing when it comes establishing effective and compliant leave programs. Every year the Disability Management Employer Coalition (DMEC) hosts their Compliance Conference, where experts from around the nation discuss current trends in compliance, best practices for employers, and the future of the industry. This year I traveled to the beautiful (and warm) Orlando, Florida, to attend this year’s conference. As per usual, the conference provided a great platform for networking and ensuring attendees are tuned into the most pressing compliance matters.

This year, my colleague, Jennifer Campagna and I presented on Navigating Ancillary Paid Leave Options to Support Employee Well-Being, but with a unique twist. We included an interactive game to help attendees understand the benefits of ancillary leave options and how they can intertwine with your current offerings. During the session we handed out “Leave Bingo”, a Bingo-style game where attendees listened for key works and concepts throughout the presentation, to see if they have the words on their Bingo board. Winners received prizes and we all got a little pick-me-up from the chocolate provided. I was impressed with the leave offerings employers across the nation have adopted, some of which we covered in our presentation, like leave related to domestic violence, bereavement, mental health, and more. Although all these ancillary options sound great, they can be costly and difficult to manage from a compliance standpoint.

Aside from the game, we reviewed federal and state laws influencing corporate leave policies and how successful companies are managing their policies. Our presentation included case studies on organizations that implemented alternative leave programs and how it impacted their workforce. Many employers have realized one key to retaining/recruiting talent and combating productivity loss is by revaluating their leave policies and addressing pain points.

Some less traditional types of leave include:

- Religious observance leave

- Wellness days

- Caregiving leave

- Compassionate leave

- Humanitarian leave

- Sabbatical leave

- Time off as a gift or donation

- Time Off in Lieu of Working Overtimes (TOIL)

- Pet bereavement leave

As a board member of DMEC and an advocate for equitable paid leave programs, I am delighted to see where the future of the industry is headed. It is unlikely that we will see a nation-wide Paid Family and Medical Leave (PFML) program introduced in 2023, but we are consistently seeing updates and clarifications to regulations such as the Family and Medical Leave Act (FMLA) and the Americans with Disabilities Act (ADA), in addition to the uptick in state PFML programs and adjustments to existing state plans. Spring and I will continue to keep you up to date with updates in the absence management space and provide our clients with industry-leading programs that best match the needs of their specific workforce.

*Additionally, all Spring/Alera clients receive complimentary access to AleraHR and Alera Dashboard, which provide digital tools that help employers and HR teams manage employee benefits compliance deadlines and updates. It also provides users with a robust compliance library with insightful guides, comprehensive checklists, tools and calculators to create forms, job descriptions, explore salary comparisons.

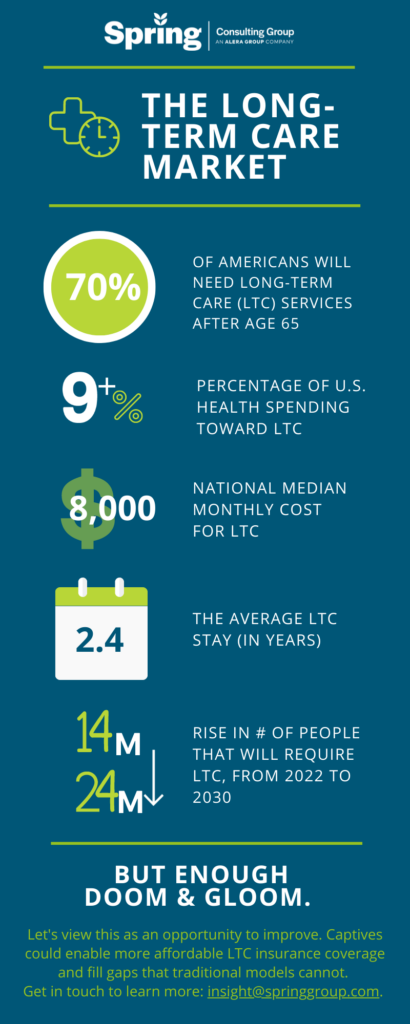

At the VCIA 2022 Annual Conference, our Managing Partner participated in a panel that highlighted the scary long-term care landscape, but that ended on a high note in exploring the possibility of captives as a next generation solution for long-term care insurance.

With innovation embedded in the DNA of both Spring and captive insurance, we are interested in helping reshaping the long-term care market of the future. Check out the other discussions our team members had on VCIA session panels, or get in touch to talk in more detail about long-term care captive strategies.

Pharmacy Benefit Managers (PBMs) serve as intermediaries between insurance companies, pharmacies, and drug manufacturers. Large PBMs are often accredited with securing lower drug costs through volume discounts and aggressive negotiations with manufacturers, which has the potential to make prescription medication more affordable. Unfortunately, many large PBMs lack the transparency that would be required to validate their impact on the cost of prescriptions.

As employers work to find optimal partners, it is important to understand the primary PBM models available in the market and how they align with each employer’s corporate culture. Each model has its own set of pros and cons, so there is not one optimal solution. The key when evaluating is to understand the strengths and weaknesses of the model you are leveraging so you continue to move toward the best approach for your organization and employees. At a high level there are three types of PBM pricing models:

- Traditional Pricing

- Pass Through Pricing

- Hybrid

Traditional Pricing

In Traditional Pricing, also known as spread pricing, PBMs are reimbursed at a higher rate by health plans and self-insured employers than what they are paying manufacturers and pharmacies for the drug. The PBM keeps the difference to offset their administrative costs as well as profit margins. This model is sometimes referred to as spread pricing, which is leveraged by most of the largest PBMs in the market. The model has been highly scrutinized as very little financial data is available and contractual gag clauses often leave insurers and employers with little knowledge of the actual price of the drug. In addition, some prescriptions also have a rebate payment made but only aggregate information is shared, making it impossible for health plans and employers to understand the true cost. With that said, given the buying power of these large PBMs, even with increased spread, employers may still save money within a traditional pricing model.

Pass-Through Transparent Pricing

The Pass-Through Transparent model operates based on the actual costs of the drugs. Clients are billed the amount the PBM is paying the manufacturer and/or pharmacy. All Rx rebates and discounts are passed onto the client. The PBM is compensated not through traditional/spread pricing but through an administrative charge, typically at the prescription level. Although this model seems more economical, PBMs leveraging a pass-through model may not always have the buying power of the traditional pricing PBMs and therefore savings may or may not be realized by health plans or self-insured employers. It is often hard to quantify savings in advance since pharmacy utilization under traditional pricing PBMs are steering utilization to those prescriptions that have the most margin for the PBM in the form of discounts and rebates.

Hybrid

The Hybrid model is a mix between the Traditional Pricing and Pass-Through Transparent models. In this model, rebates and discounts are typically passed to client(s), but it may or may not be in full. Some hybrid models indicate all received rebates are passed back to clients but may have an intermediary that receives some spread that is not disclosed and not considered a rebate. In short, hybrid PBMs have diverse disclosure practices. At a quick glance it may seem more transparent, but it’s difficult to validate.

Solving for the Transparency Issue

With the lack of transparency, some policies at the state and federal level aim to decrease the complexity. For example, most states with transparency laws require reporting from manufacturers when wholesale cost is increased above a certain threshold. The first drug transparency law was passed in 2016 in Vermont, but now over 20 states (including CA, CT, ME, MN, NV, NH, ND, OR, TX, UT, VA, WA, WV) have implemented their own requirements. Maine has one of the more robust approaches, collecting and analyzing the data with the goal of identifying each supply chain’s average net, allowing the public and policymakers to follow the money through the supply chain[1].

The Consolidated Appropriations Act also has requirements for pharmacy reporting that will require PBMs to report on some data that is rarely shared, including but not limited to rebates by drug for the top 25 prescriptions. In some instances, PBMs will share that data with health plans and self-insured employers; in other instances, they will file directly with Centers for Medicare & Medicaid Services (CMS) without employers understanding those plan details.

More recently, on May 24, 2022, the Pharmacy Benefit Manager Transparency Act of 2022 was introduced. Sponsored by Senator Chuck Grassley (IA) and Senator Maria Cantwell (WA), this bill will empower the Federal Trade Commission (FTC) to increase drug pricing transparency and hold PBMs accountable for unfair practices that increase cost. It also will require PBMs to report to the FTC the amount of money they make through spread pricing and pharmacy fees[2].

While we wait to see if the Pharmacy Benefit Manager Transparency Act is passed, other solutions are available. There are companies that are striving to help clients save money when it comes to prescription drug costs. They often run analyses on current employer prescription drug costs to determine how much they could save if they moved away from traditional PBM models.

At edHEALTH, we work hard with our member-owner schools to bend the trend in healthcare costs. Pharmacy continues to be an expensive cost-driver, at a national level, and something we’re addressing head-on. We continuously look for opportunities to bend the trend in healthcare costs, including exploring all options to reduce prescription drug costs.

Tracy Hassett, President and CEO of edHEALTH

When our client, edHEALTH, carved-out prescription drug benefits, the goal was to provide additional savings and transparency to its members. edHEALTH continues to work with their vendors and evaluate various options so that they can offer additional transparency and cost savings. To learn more about potential solutions, talk to your current advisor or reach out to Spring Consulting Group.

[1] https://www.nashp.org/drug-price-transparency-laws-position-states-to-impact-drug-prices/

[2] https://www.natlawreview.com/article/pbms-continue-to-draw-federal-scrutiny-pbm-transparency-act-2022#:~:text=The%20Pharmacy%20Benefit%20Manager%20(PBM,and%20state%20attorneys%20general%20in

In our latest podcast on Global Captive Podcast, our Managing Partner is joined by President and CEO of Spring’s client, edHEALTH to discuss the evolution of the captive program and its success.

A (Brief) VCIA Session Recap

I had the pleasure of speaking at Vermont Captive Insurance Association (VCIA) Annual Conference last week, joined by two colleagues with impressive backgrounds. Jeff Caudill, Director of Risk Management at Haskell and a client of Spring’s, and Mary Ellen Moriarty, Vice President, Property & Casualty at College Insurance Company (EIIA) joined me to discuss different ways that captives can be used to tackle the hard market hurdles we’re currently facing in the insurance industry.

With myself as the moderator and consulting actuary, Jeff representing a brand new single parent captive, and Mary Ellen representing a veteran captive, it was a well-rounded panel that pulled in multiple perspectives.

The Clouds Behind the Hard Market

This visual does a great job at illustrating the many challenging atmospheric effects in the insurance air right now, particularly on the property & casualty (P&C) side of the fence (no pun intended). With Mary Ellen representing the higher education space, we felt it important to highlight unique risks that colleges and universities are grappling with, in addition to the other complicating factors (or clouds) we see here.

In my work I’ve seen that this climate has resulted in increased carrier profitability for certain lines over the last couple of years, such as auto liability, but decreased carrier profitability in others (such as cyber and commercial property).

In higher education, Mary Ellen explained there have been hard market consequences due to underwriter inability to achieve profitability, and as noted in the visual, they are dealing with risks many organizations don’t need to think about, like traumatic brain injuries, the general public accessing the property, and a different kind of medical malpractice. As a result, there are a limited number of carriers willing to provide coverage in this space. As a nod to captive advantages, EIIA was able to grow surplus from their captive prior to the hard market, from 2002 to 2022, which has been extremely helpful in this “stormy environment.”

This success story led us to a discussion around the business case for captives, a snapshot of which you can see here in this video.

Jeff then gave a bit of a play-by-play regarding the process, implementation, timelines and driving forces behind Haskell’s decision to switch from a group captive to a single parent captive (a synopsis of which you can find in this case study).

Looking Ahead

Both Jeff and Mary Ellen described some next steps for their captives, which may include writing in:

- Integrated deductible plans

- Directors & officers

- Cyber

- Employee benefits

- Other P&C lines

Food For Thought

Like most good things in life, you kind of had to be there to get the full experience and maximize your take-aways. So I don’t want to give it all away, but I will leave you with some food for thought that came out of the Q&A for the session. If you want to know the answers, please get in touch!

- With a newer captive that hasn’t had time to build up surplus yet, how do you think about keeping your captive adequately capitalized?

- What are the next coverages or exposures you see on the horizon for higher ed that you would like to add to the captive program?

- What were the key drivers for your CFO to be on board to establish the captive?

- Can you talk about how reviver statutes have impacted obtaining/maintaining abuse coverage?

- As we face uninsured risks like communicable disease, how do you assess the use of the captives together with unique insurance solutions like parametric options? What is the value pitch to the organization?

- What type of coverages perform well in the hard market and why?

- Does forming a captive in a hard market only make financial sense if your company’s loss ratio is below the industry average?

- How do you handle cyber in a captive? Do you have a TPA on retainer?

- Are you using the captive for deductible reimbursement? Do you take any quota share or excess layer risk?

- What does your auto exposure look like and what risk mitigation strategies have you implemented (via the captive or otherwise)?

- How do you market your captive to new members who may not understand captives? Especially in light of the hard market, where captives are especially attractive.

And last but perhaps most importantly:

- What do you think the impact to the insurance market will be if the Browns win more than 2 games this year?

As you can see, we can have some fun in the captive world, and much of it was had at VCIA! Before you leave, check out our captive business case video here, inspired by this presentation.

In this quick video, we outline 6 points that build the business case for captives. Check them out if you are struggling with getting executive buy-in to enter the captive space, or even if you are looking to do more with your existing captive.

Our Managing Partner, Karin Landry led a panel discussion at the Vermont Captive Insurance Association (VCIA) Annual Conference on the potential use of captive insurance to be a tool for long-term care insurance in the future. Check out this article in Captive International which summarizes key points of the discussion.

This year marks the 30th anniversary of the formation of the Disability Management Employer Coalition.

Check out this background on DMEC, including inputs from our Senior Vice President, Karen English.